Why is it important for exchange houses in Qatar to re-assess their current business positioning

Exchange houses in Qatar dominate the international remittance industry by facilitating more than 1 million transactions on a monthly basis. As of June 2021, there were 20 exchange houses operating with a total of 141 branches located in different provinces of Qatar. Al Dar for exchange works, established in 2006, operates highest number of ~21 branches across Doha, Ar Rayyan, Al Khor etc.

Everything was faring well in the industry before the onset of pandemic of COVID-19 and corresponding restrictions on mobility that deeply affected the money exchange industry. During lockdown restrictions, many expat workers, which contribute ~88% of total Qatari population, returned to their home countries and temporary closure of exchange houses made it difficult to remit money back home. While, customers with sound digital know-how were early to comply with e-KYC requirements and transact via online solutions, it was the blue collar workforce which ended up being the victim of digital divide.

Digital is the Future:

While the business activity has attained pre-COVID levels for major exchange houses, a noticeable trend has been double digit to multi-fold Growth in Online Transactions of Remittance via digital solutions offered by exchange houses. Leveraging 99% internet penetration rate in Qatar and high time spent on social media engagement, exchange houses are also envisioning to undertake investments in development of digital solutions and extending partnerships with digital players. For instance – partnership of Ooredoo Money with Al Dar Exchange, partnership of Lulu Money with Mastercard in UAE depict the growing focus of incumbents towards digitalization.

What can exchange houses do to ride the wave of digitalization?

Almost every exchange houses has launched its digital solution (web/mobile application/both), it is now pertinent for the operators to leverage it for smooth customer acquisition, high standards of servicing and connected customer retention. An ideal digital solution focuses on customer satisfaction at each stage and aims to reduce the transaction time by offering a hassle free experience.

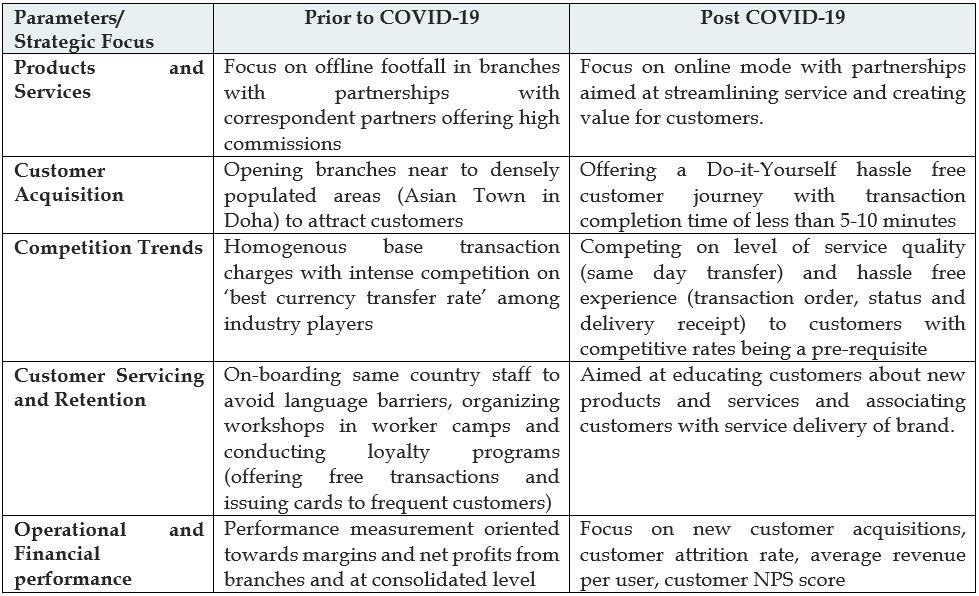

The below table summarizes the shift in strategic focus of major exchange houses prior to and post COVID-19 on select parameters:

While, the transformation to digital solutions might put pressure on bottom-line figures in initial years; the improvement in unit-economics, expected life-time value and benefits completely outweigh the costs attached to it. Moreover, to compete with global MTOs (Western Union, Xpress Money, Wise, and Moneygram etc.), regional players (Xare, STC Pay, Denarii) and domestic start-ups (C-Wallet), it is pertinent for incumbents to re-assess their current positioning and retain customers by offering advanced solutions.

Request For Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=NDg0NzMy

Key Topics Covered in the Report

Overview of International Remittance Industry in Qatar (Statistics on Corridor wise Transaction volume and value)

Industry segmentation (By Type of Transfers, Type of Intermediary Operators, Corridor wise, Type of Source Entities)

Cross Comparison of Major Exchange houses on Operational and Financial Parameters (December 2020, June 2021)

Company Profile of Major Exchange Houses (Overview, Products and Services, USP, Business Strategies, Branch wise Operational Performance, Cumulative Financial Performance, Recent Developments)

Growth Drivers and Challenges to Qatar International Remittance Industry

Industry trends and developments

Rules and Regulations by Government Bodies

Impact of COVID-19 and Future Outlook of Industry

For More Information, refer to below link:-

Qatar Central Bank AML Guidelines | Commission rate Banking Partners Qatar

Related Reports

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

+91-9015378249