Thailand News

The pandemic (2019-20) led to a sharp incline of a double digit growth rate as it brought realization among Thais to buy new policies or port to insurers who offer better coverage and claim settlement.

Thailand Online Insurance Market Overview

Impact of Digital: With increasing internet penetration rate and wide awareness of e-commerce, online platforms are making sure of smooth, intuitive, and time-saving customer experience which is achieved by incorporating fast and efficient ways of purchasing insurance online via verification of insurance company’s credibility by checking their incurred claim ratio, customer reviews; instant insurance issuance; minimal paperwork and lower insurance premium and more.

COVID- 19: The Pandemic is the major driver of the growth in Thailand’s Online Insurance Market which has spurred Health Insurance in the country as people were inclined toward family health security especially in emergencies and uncertain circumstances. It led to a sharp incline of a double digit growth rate as it brought realization among Thais to buy new policies or port to insurers who offer better coverage and claim settlement.

Request for Free Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=NTk2MDA1

Government Initiatives: The digital revolution in the country is driving the overall market growth with policies like “Insurance Development Plan 4.0” in establishing a stable and sustainable insurance system that facilitates a healthy competition in the digital economy through the adoption of new innovations and technologies where the public, the private and the people will have an easy access to the insurance as a risk management tool for the citizens’ well-being. Compulsory Motor Insurance by the government agencies have also increased the insurance growth in the country.

Challenges in the Market: The market is challenged integrating new technology into existing systems, lack of speed to deliver new services into the market, high it run time cost before migrating to digitally enhanced systems, lack of it expertise, analyzing a large volume of customer data, cyber threats and more. However, these challenges can be managed with providing efficient customer-oriented service and leverage technology to forecast and optimize outputs. To embrace full digital transformation, insurance companies must overcome different barriers to modernize their operations from integrating new technology to tackling with cyber threats.

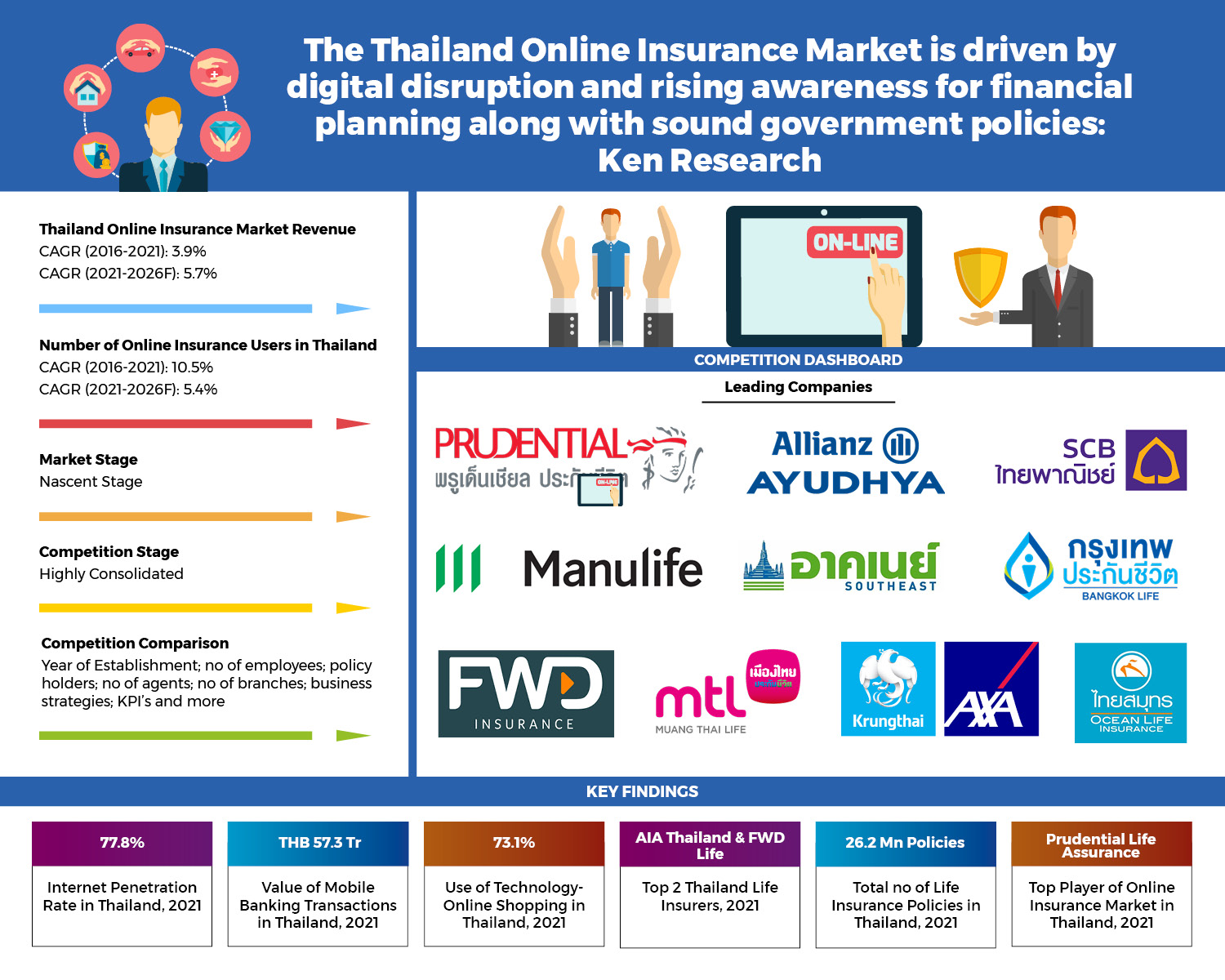

Analysts at Ken Research in their latest publication “Thailand Online Insurance Market Outlook to 2026F- Driven by digital disruption and rising awareness for financial planning along with sound government policies” by Ken Research observed that with the online insurance industry being at the nascent stage, the marketplace offers wide opportunities at affordable premiums as multiple players enter the market. The market is expected to grow @5.7% CAGR (2021-2026F) owing to the increase in smart phone penetration rate and increased consumer spending on different life and non-life insurance due to growing penetration of internet and smart phones and increasing safety measures for emergencies are driving the market in Thailand.

Key Segments Covered in the report

Thailand Online Insurance Market

- By Product Type

- Life Insurance

- Non-Life Insurance

- By Non-Life Insurance

- Health Insurance

- Motor Insurance

- Property insurance

- Others

- By Region

- Bangkok

- Songkhla

- Lamphun

- Others

- By Income

- Less than 40k

- More than 40k

- By Mode of Distribution

- Agents

- Aggregators

- Company Website

Key Target Audience

- Insurance Industry

- Online Insurance Companies

- Policy Consultants

- Life and Non-Life Insurers

- Government Agencies

- Private Insurance Agents

- Insurance Brokers

- Market Research and Consulting Firms

Time Period Captured in the Report:

- Historical Period: 2016-2021

- Base year: 2021

- Forecast Period: 2022F-2026F

Number of Online Insurance Companies in Thailand

Companies Covered:

- Prudential Life Assurance

- Muang Thai Life Assurance

- Bangkok Life Assurance

- South East Life Insurance

- Ocean Life Insurance

- FWD Life Insurance

- Allianz Ayudhya Assurance

- SCB Insurance

- Manulife Insurance

- Krungthai AXA Life Insurance

Key Topics Covered in the Report

- Executive Summary of Thailand Online Insurance Market

- Thailand Country Overview

- Thailand Insurance Sector Overview

- Thailand Online Insurance Market Genesis and Overview

- Major Challenges in Thailand Online Insurance Market

- Comprehensive Analysis on Thailand Online Insurance Market (Market Size, 2016-2026F; Market Shares; Future Trends)

- Industrial Analysis of Thailand Online Insurance Market

- Government and Private Initiatives for Thailand Online Insurance Market

- Technologies Shaping Thailand Online Insurance Market

- Competitive Landscape in Thailand Online Insurance Market

- Analyst Recommendations

Related Reports:

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

+91-9015378249