The gold mining industry, driven by centuries-old allure and modern economic dynamics, plays a pivotal role in meeting the world’s demand for this precious metal. This article provides a comprehensive overview of the gold mining market, shedding light on its revenue, growth trajectory, and the key drivers fueling its expansion.

Market Overview: Unraveling the Gold Mining Landscape

The gold mining market encompasses a diverse array of activities, ranging from exploration and extraction to processing and distribution. With gold being one of the most sought-after metals worldwide, the market is characterized by both large-scale mining operations and artisanal mining activities, spanning continents and cultures.

Revenue Insights: The Economic Significance of Gold Mining

Gold mining contributes significantly to global economic output, generating substantial revenue streams for countries and companies alike. In 2022, global gold production exceeded 3,500 tonnes, with China, Australia, Russia, and the United States emerging as the leading producers. The economic impact of gold mining extends beyond production, encompassing ancillary sectors such as refining, jewelry manufacturing, and investment.

Growth Trajectory: Charting the Course of the Gold Mining Market

The gold mining market has witnessed a steady growth trajectory over the years, driven by various macroeconomic factors and industry dynamics. Market analysts project a compound annual growth rate CAGR of around 2.5% for the global gold mining market from 2023 to 2028. By 2028, the market size is expected to reach USD 220 billion, reflecting sustained demand and ongoing exploration efforts.

Growth Drivers: Propelling the Gold Mining Industry Forward

Several factors underpin the growth of the gold mining market, shaping its evolution and driving investment decisions across the value chain. Understanding these drivers is crucial for stakeholders seeking to navigate the complexities of the industry and capitalize on emerging opportunities.

-

Economic Uncertainty and Safe-Haven Demand

Gold has long been viewed as a safe-haven asset during times of economic uncertainty and market volatility. Amid geopolitical tensions, currency fluctuations, and inflationary pressures, investors flock to gold as a store of value and a hedge against systemic risks. This heightened demand for gold as a financial instrument bolsters mining activity and supports price levels.

-

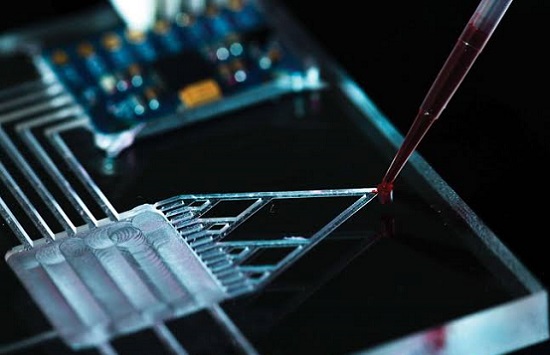

Technological Innovation and Exploration Advances

Advancements in mining technology, exploration techniques, and resource assessment tools have expanded the scope of gold mining operations and unlocked new reserves. From remote sensing and geophysical surveys to machine learning algorithms and data analytics, technological innovation has enhanced efficiency, reduced exploration risks, and improved resource estimation accuracy.

-

Supply-Demand Dynamics and Gold Consumption Trends

The interplay between supply and demand dynamics profoundly influences the gold mining market. While gold production continues to meet global demand, consumption patterns vary across different regions and sectors. Emerging markets, particularly in Asia, drive demand growth for gold in jewelry, electronics, and investment products, offsetting declines in traditional markets.

-

Regulatory Environment and Environmental Sustainability

Environmental regulations, community engagement, and sustainability practices play an increasingly pivotal role in shaping the gold mining landscape. Companies are under pressure to adopt responsible mining practices, minimize environmental impacts, and ensure social license to operate. Compliance with stringent regulations and adherence to industry best practices are imperative for long-term viability and reputation management.

Conclusion: Navigating the Path Forward in the Gold Mining Market

As the gold mining market continues to evolve amidst shifting economic, technological, and regulatory landscapes, stakeholders must remain vigilant and adaptable to seize opportunities and mitigate risks. By staying abreast of market trends, leveraging innovation, and embracing sustainability, the industry can sustain its growth trajectory and uphold its pivotal role in the global economy.