The report titled “UAE Cold Chain Market Outlook to 2025 – The Cold Chain Market in UAE is Thriving with the Advent of Government’s Economic Diversification Plans Coupled with UAE’s Increasing Adoption of Technology and Automation” provides a comprehensive analysis on the Cold Chain Market in the UAE. The report covers various aspects including overview and market size, market segmentation, stakeholders, value chain analysis, major players, competitive landscape, operating and profitability model, end-user potential in the cold chain industry and many other influential factors. The report concludes with market projections and analyst recommendations highlighting the major opportunities and cautions for the cold chain market players.

UAE Cold Chain Market Overview and Size

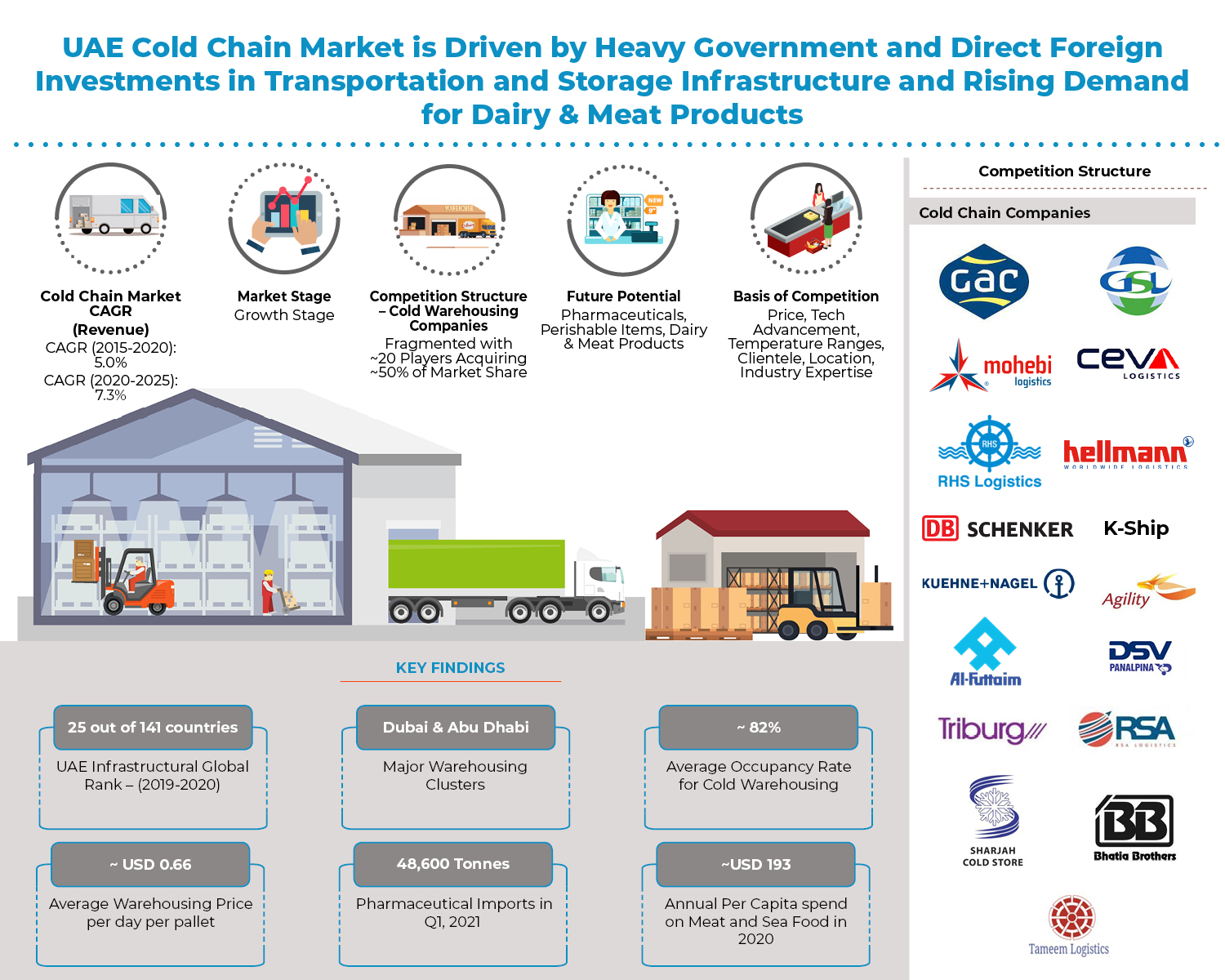

The cold chain market in UAE is at growth stage. It has consolidated its position as a global transhipment hub due to its central location in the GCC region. The high dependence of the country on imports to meet its food requirements has necessitated the development of cold chain facilities. In the review period 2015-2020, the UAE cold chain market has increased at a positive CAGR of 5.0% largely due to heavy government and direct foreign investments in transportation and storage infrastructure, increase in retail and consumer spending especially in groceries, dairy, meat, international food and EXPO 2020.

UAE Cold Chain Market Segmentation

Cold Warehousing

The cold storage market is dominating the market and contributed majority revenue share to the cold chain industry. Majority of the cold storage warehouses are located in free-zones in Dubai and Abu Dhabi like JAFZA, DIP, DIC, Al Aweer, etc. Some of the key growth drivers include increase in retail distribution cold storage, set up of new warehouses, creation of large food and Pharma reserves by government, growing end users in emerging markets. Seasonal surge in demand is seen especially during the Ramadan festival.

Cold Transportation

The industry caters to distribution of food and pharma domestically and internationally via land, sea and air. The market experienced a slight slowdown in growth during 2020 owing to global pandemic Covid-19, which led to lockdown across the country for few months. Some of the key growth drivers include increase in retail distribution, growing end users in emerging markets, increasing import of perishables, tech advancements such as Transport Management Systems used by cold chain players.

UAE Cold Warehousing Market Segmentations:

By Temperature Range (Ambient, Chilled and Frozen): Chillers and freezers were quite high in demand in the year 2020 given the increase in the consumption of frozen and fresh food items.

By Ownership (Integrated and Contract Warehouses): Integrated logistic facilities generate larger revenue share. This is majorly due preference of logistics companies to invest into warehouses and closely monitor operations themselves as opposed to outsourcing them.

By End-User Application (Meat and Seafood, Dairy Products, Pharmaceuticals, Fruits and Vegetables and Others): Meat and Seafood contributed the highest revenue share owing to the tremendous increase in the demand for meat during the lockdown. The demand for pharmaceutical products was quite high due to the onset of the pandemic.

By Major Emirates (Dubai, Abu Dhabi, Sharjah and Others): Dubai accounts for the highest share in the revenue of the cold storage market as it acts as a hub from where products are transported to other regions.

By Areas (JAFZA, DIP, DIC, Al Aweer and Others): Jebel Ali Free Zone accounted for the maximum share in the revenue of the cold storage market and hosts over 8,700 companies. It is considered as the world’s largest free zone.

UAE Cold Transportation Market Segmentations:

By Mode of Transport (Land, Sea and Air): Cold transport through land contributed the highest revenue to the cold transport industry as food imports into the country through ports are transported to different cities via land transport. Majority of the domestic transportation takes place through the well-developed road infrastructure in the country as most places are quite accessible via road.

By Type of Freight (Domestic and International): Cold transportation to international markets accounted for majority of the revenue of the UAE cold transport industry due to the reliance of the country on imports for its food requirements.

By End-User Application (Meat and Seafood, Dairy Products, Pharmaceuticals, Fruits and Vegetables and Others): Meat and seafood has positively impacted cold chain industry followed by Dairy Products. UAE has the highest consumption levels for meat and seafood in the world.

By Contract and Integrated Logistics: The cold chain market in the UAE is dominated by 3PL facilities, generating largest share in market revenue. This is majorly due to the large number of 3PL operators providing wide variety of services and increasing shift towards outsourcing cold transport requirements by cold chain companies.

Competitive Landscape

Competition in UAE Cold Storage Market is highly fragmented with ~20 large companies acquiring chunks of market share. The market is highly concentrated in places like Dubai and Abu Dhabi ports and free zones. The rising urban population, developed transport infrastructure in these regions along with the proximity to the sea and air ports has been the key factors leading to the growth of the cold chain businesses in these areas. The cold chain companies in the country compete on a host of parameters such as location, price, temperature range, product range, warehouse infrastructure, industry expertise, clientele, etc. Major players in the cold chain market include GAC, GSL, Mohebi Logistics, CEVA Logistics, RHS, Hellmann, DB Schenker and others.

UAE Cold Chain Market Future Outlook and Projections

The Cold Chain market in UAE is expected to experience medium level of growth at a single digit CAGR in terms of revenue during the period 2020-2025F. Positive growth in the market is attributed to rise in manufacturing activity in the pharmaceutical sector, investments in infrastructure, growth in dairy industry and rising import export volumes. The industry is expected to witness entry of new players and new mergers and acquisition between the players. Additionally, increasing adoption of warehouse automation technologies such as EDI, RFID, AS/AR and others are expected to improve operational efficiency in UAE cold chain market over the forecast period 2020-2025F.

Key Segments Covered

By Type of Market

- Cold Storage

- By Temperature

- Ambient

- Chilled

- Frozen

- By Ownership

- Integrated

- Contract

- By End-User Application

- Meat and Seafood

- Dairy Products

- Pharmaceuticals

- Vegetables and Fruits

- Others

- By Major Emirates

- Dubai

- Abu Dhabi

- Sharjah

- Others

- By Major Areas

- JAFZA

- DIP

- DIC

- Al Aweer

- Others

- Cold Transport

- By Mode of Freight

- Land

- Sea

- Air

- By Type of Freight

- Domestic

- International

- By Contract and Integrated Logistics

- Integrated

- Contract

- By End-User Application

- Meat and Seafood

- Dairy Products

- Pharmaceuticals

- Vegetables and Fruits

- Othe

Request For Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=NTE1MTg1

Key Target Audience

- Cold Chain Companies

- Logistics Companies

- Government Associations

- Express Logistics Companies

- Industry Associations

- Warehousing Companies

- E-Commerce Operations

- Investors and Private Equity Companies

- Logistics Companies

- Dairy Companies

- Meat and Seafood Companies

- Fruits and Vegetables Companies

- Pharmaceutical Companies

Time Period Captured in the Report

- Historical Period: 2015-2020

- Forecast Period: 2020-2025F

Companies Covered

- GAC

- GSL

- Mohebi

- CEVA

- RHS

- Hellmann

- DB Schenker

- Khalidia Shipping

- Kuehne and Nagel

- Agility

- Al Futtaim

- DSV Panalpina

- Triburg

- RSA Cold Chain

- Sharjah cold stores

- Bhatia Brothers

- Tameem logistics

Key Topics Covered in the Report

- UAE Cold Chain Market Overview

- Infrastructure Analysis

- Existing and Emerging Technologies

- UAE Cold Chain Market Value Chain

- UAE Cold Chain Market Size by Revenue, 2015-2020

- UAE Cold Chain Market Segmentation and Segment Future, 2020-2025F

- End User Industry Analysis And Future Growth Potential

- UAE Cold Chain Market Competitive Landscape

- UAE Cold Chain Market Company Profiles of Major Players

- Regulatory Environment

- Industry Trends and Developments

- Industry Issues and Challenges

- Analyst Recommendation

- UAE Cold Chain Market Future Outlook and Projections, 2020-2025F

- UAE Cold Chain Market Analyst Recommendations

Related Reports

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

+91-9015378249