Key Findings

- Increase in use of customer self-service (CSS) platforms offers tangible benefits, such as, lenders and collectors can get a single view of each consumer and their payment status, including automated follow-up actions and recommendations to streamline the collection process.

- As accounts are processed, they automatically move to the next activity based on defined rules, policies and procedures — while enforcing business rules through robust workflow policies and permissions.

Rise in Digital Collection Techniques:

For decades, the debt collection sector has used a phone-first technique, relying on the customer’s availability and willingness to respond to the debt collection action. However, this results in a terrible customer experience. Debt collection companies are resorting to digital collection techniques. This successfully engages customers by removing negative thoughts and emphasizes that the lenders are there to assist them.

Increasing Use of AI and ML for Recovery Predictions:

Artificial Intelligence and Machine Learning are enabling better recovery predictions and ongoing case management. Moreover, AI also helps with regulatory compliance. AI-based collections management software is bound to find higher usage in the coming years.

Distinctive Role of Collection Agents:

As the use of automation increases, the role of collection agents will become more nuanced. Collection agents will have to be adept at gauging consumer situations and providing them with solutions that are feasible, encouraging, and more likely to show results.

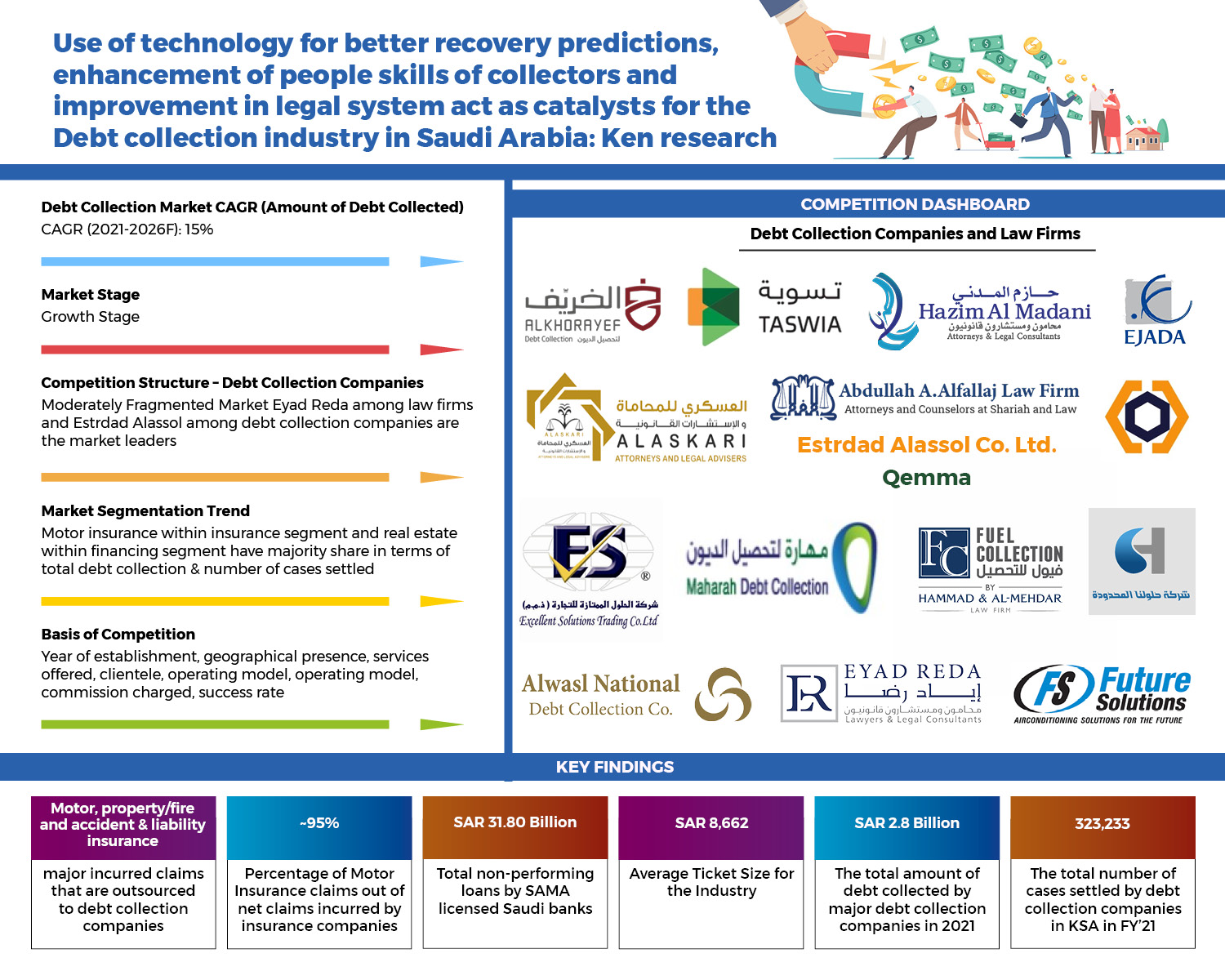

The report titled “KSA Debt Collection Market Outlook to FY’2026 – characterized by fierce competition and high growth prospects” provides a comprehensive analysis of the potential of the Debt Collection industry in Saudi Arabia. The report covers various aspects including the current debt collection scenario and status in KSA, market size on the basis of debt collected, number of cases settled and revenue, market share of debt collection companies, Market segmentation by the segments, by type and age of firm, by sub-segmentation of insurance, finance and non-finance segment. Major trends and developments, issues and challenges, government regulations, competition landscape and cross comparison. The report concludes with case studies, analyst recommendations and key market opportunities.

Key Segments Covered in KSA Debt Financing Market:

- By Segments

- Insurance

- Financing

- Non-Finance

- By Type of Firm

- Debt Collection Companies

- Law Firm cum Debt Collection Companies

- By Age of Firm

- 2-7 years

- 7-14 years

- 12-17 years

- By Geography

- Riyadh Province

- Maddah Province

- Eastern Province

- Al Baha Province

- Al Jawf Province

- Northern Borders Province

- Qassim Province

- Ha’il Province

- Tabuk Province

- Aseer Province

- Jizan Province

- Najran Province

- By Sub-Segment of Insurance Segment

- Motor

- Property/Fire

- Accident & Liability

Request for Sample Report @

https://www.kenresearch.com/sample-report.php?Frmdetails=NTk2MDk2

By Sub-Segment of Non-Finance Segment

- Commercial and Professional Services

- Consumer Services

- Energy

- Food & Beverages

- Real Estate Management and Development

- Telecommunication Services

- Transportation

- Utilities

- By Sub-Segment of Finance Segment

- Real Estate Financing

- Retail Real Estate Financing

- Corporate Real Estate Financing

Companies Covered

- Alwasl National Debt Collection Co.

- Alkhorayef Collection

- Future Solutions

- Taswia

- Fuel Collection

- Estrdad Alassol Co. Ltd.

- Marsoom (Sadad)

- Ejada

- Maharah Debt Collection

- Excellent Solutions Co.

- Hololona Company Ltd.

- Qemma

- Hazim Al Madani Law Firm

- Abdullah A. Al Fallaj Law Firm

- Eyad Reda

- Alaskari Law Firm

Key Target Audience

- Existing Debt Collection Companies

- Law Firms

- Financing Companies

- Non-Financing Companies

- Insurance Companies

- Debt Collection & Management software providers

- Government Agencies

- Finance Consultants

- Others

Time Period Captured in the Report: –

- Base Year: 2021

- Forecast Period: 2022-2026F

Key Topics Covered in the Report

- How is the Debt Financing Market positioned in KSA?

- Overview of Insurance, financing and non-finance sector in KSA

- KSA Debt Collection Market Ecosystem

- Growth Drivers, Trends and Developments in the market

- Government Regulations

- Porter’s Five Forces Analysis for KSA Debt Collection Market

- Market Size and Segmentation, 2021-2026F

- Competitive Landscape of KSA Debt Collection Industry

- Cross Comparison of Major Players using fundamental, operating model, clientele, geography and service offering parameters

- Case study & Analyst Recommendations

- Research Methodology

For more information on the research report, refer to below links:

Debt Collection Services in Saudi Arabia

Related Reports

Contact Us:

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249