By an Independent Market Analyst | Primary Data Source: Ken Research

India’s road freight sector is experiencing significant growth, driven by the surge in demand for efficient logistics solutions, the expansion of e-commerce, and increasing investments in infrastructure. The sector’s evolution is being further accelerated by technological advancements, electrification, and the country’s ambitious sustainability goals. The market is expected to maintain steady growth, with increasing demand for cost-effective and reliable freight transportation solutions playing a central role.

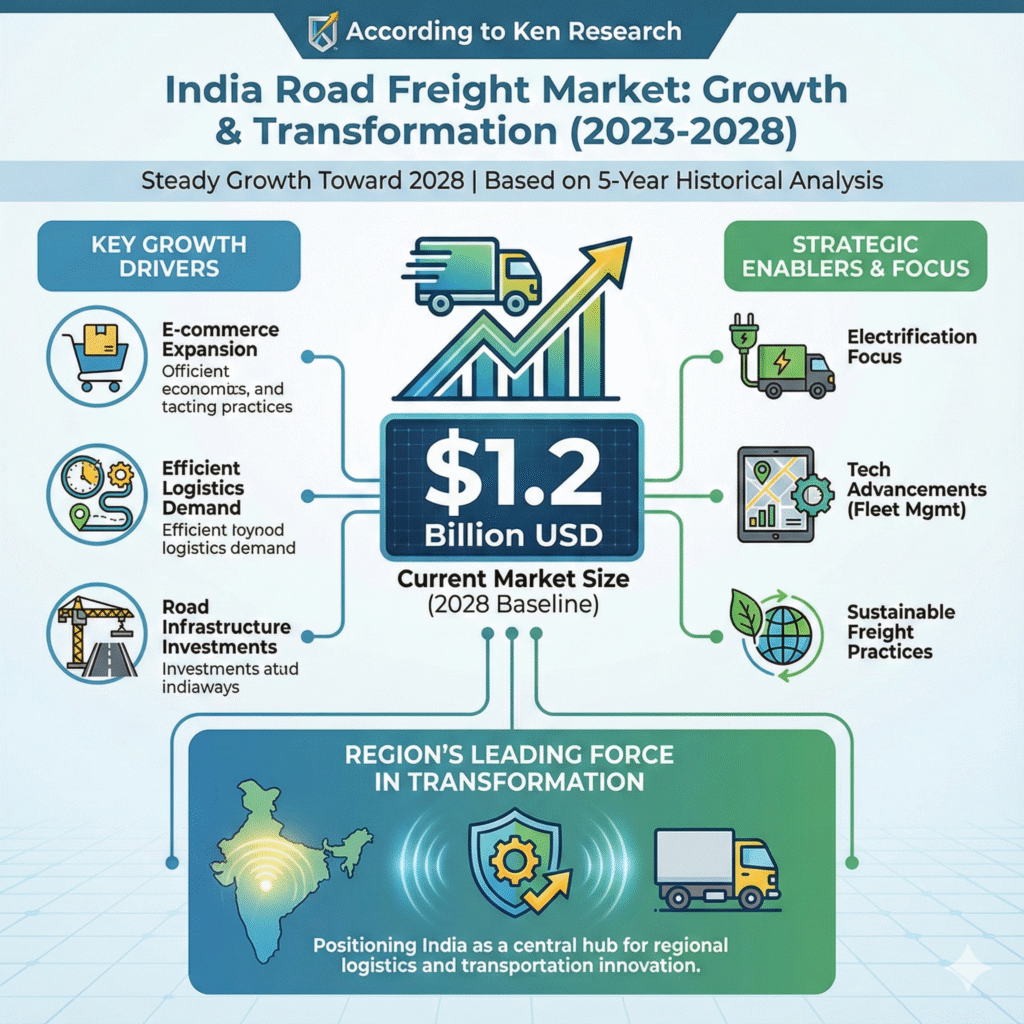

According to Ken Research, the India road freight market is set for steady growth toward 2028, with the current market size valued at USD 1.2 billion, based on a five-year historical analysis. This growth is driven by increased demand for efficient logistics solutions, the expansion of e-commerce, and significant investments in road infrastructure. India’s focus on electrification, technological advancements in fleet management, and the adoption of sustainable freight practices continue to position it as a leading force in the region’s logistics and transportation transformation.

Market Overview: A Fast-Growing, Infrastructure-Driven Logistics Sector

The India road freight sector is characterized by:

- Dominance of trucks and heavy-duty vehicles in the transportation of goods across vast distances.

- Growing demand for last-mile delivery services spurred by the rapid rise of e-commerce and retail sectors.

- Significant government investments in road infrastructure projects, including highways and toll roads, to enhance freight efficiency.

- The rapid adoption of telematics and logistics management technologies to improve fleet performance and tracking.

- Increased focus on the adoption of sustainable practices, including electric trucks and hybrid vehicles, in line with India’s environmental commitments.

Growth Drivers: Government Initiatives, Technological Adoption, and Sustainability

Download the full sample report of India Road Freight Market. by Ken Research.

Strategic Government Support

The Indian government’s National Logistics Policy and the implementation of the Bharatmala Pariyojana, aimed at improving road infrastructure, have fueled the growth of the road freight sector. Policy incentives for electric vehicles (EVs) also provide a boost to the adoption of green solutions in freight transportation.

E-Commerce and Retail Sector Growth

The rapid expansion of the e-commerce sector, particularly in tier-2 and tier-3 cities, is leading to a massive surge in demand for road freight services, particularly for last-mile delivery. This trend is expected to continue as the logistics sector scales to meet growing consumer demands.

Sustainability and Electrification

As India moves toward sustainability, there is an increasing focus on electrification in freight transport. The government’s push for electric vehicles, particularly for urban deliveries, and investments in EV charging infrastructure are expected to accelerate the adoption of electric trucks and commercial vehicles in the coming years.

Technological Advancements

Technology is playing an integral role in the transformation of the road freight market. Telematics, GPS tracking, real-time fleet management systems, and route optimization tools are enhancing operational efficiency, reducing costs, and improving delivery times across the country.

Technology Trends: Embracing Smart, Efficient, and Green Logistics Solutions

The adoption of advanced technologies is helping the India road freight sector meet growing demand while improving efficiency and sustainability:

- Automated route planning and AI-driven analytics optimize delivery cycles and reduce fuel consumption.

- Telematics and GPS systems enable real-time monitoring of fleets, enhancing operational transparency and efficiency.

- EV adoption in road freight is rising, with electric trucks and cargo vehicles reducing emissions and operating costs.

- Increased use of RFID technology for inventory tracking and supply chain visibility.

- The implementation of drone technology and robotics for last-mile delivery solutions in urban areas.

Competitive Landscape: Established Leaders and Emerging Innovators

The India road freight market is competitive, with both established players and emerging startups pushing the boundaries of innovation:

- Large logistics companies and fleet operators dominate the road freight landscape, with significant investments in fleet expansion and infrastructure.

- EV manufacturers and technology startups are focusing on delivering electric freight solutions and integrating telematics into vehicles.

- Infrastructure developers are building road networks and toll systems to ease freight movement across the country.

- Logistics and supply chain management companies are enhancing their services by implementing automation and optimizing their logistics platforms.

According to Ken Research Report, the competition is intensifying as both traditional logistics companies and new entrants focus on offering high-tech, green, and cost-efficient freight solutions.

Opportunities: Key Segments Driving Future Growth

- The expansion of e-commerce and retail delivery is driving demand for fleet expansion and last-mile delivery solutions.

- The shift toward electric freight vehicles offers a massive growth opportunity in reducing carbon footprints while lowering operational costs.

- Investment in smart infrastructure, including better highways and logistics hubs, will further enhance the freight transportation sector.

- The rising adoption of logistics-as-a-service models, particularly in urban areas, will continue to fuel sector growth.

- Increasing focus on fleet management software solutions, improving efficiency and ensuring real-time data analytics in logistics operations.

Challenges: Infrastructure Gaps, Regulatory Hurdles, and Market Pressures

- A lack of modern infrastructure in some rural areas creates logistical bottlenecks and delays.

- The high cost of electric freight vehicles and EV infrastructure hampers widespread adoption, particularly in smaller fleet operations.

- Regulatory inconsistencies across states and territories increase complexity for fleet operators.

- The volatile cost of diesel and fuel impacts operational costs, creating price sensitivity in the freight sector.

- Shortage of skilled labor in EV servicing and road freight maintenance is a challenge in meeting future industry needs.

Frequently Asked Questions (Q&A Section)

Q1. What is driving the growth of India’s road freight sector?

Growth is largely driven by the government’s infrastructure investments, the rise of e-commerce, and the push for sustainable transport solutions, as highlighted in the India Road Freight Market Report.

Q2. Which vehicle categories dominate the India road freight market?

Heavy-duty trucks, medium-duty vehicles, and specialized cargo vehicles, including those used for e-commerce deliveries, are leading the road freight landscape.

Q3. How is technology influencing the road freight sector in India?

Telematics, fleet management systems, and EV technology are central to improving efficiency, reducing costs, and enhancing the environmental impact of India’s road freight operations.

Q4. What role does electrification play in India’s road freight future?

Electrification is a key component of India’s future logistics strategy, with a growing adoption of electric trucks and cargo vehicles to reduce emissions and operating costs.

Q5. What are the challenges facing the India road freight market?

Infrastructure gaps, high operational costs, regulatory inconsistencies, and labor skill shortages are among the major challenges impacting the sector’s growth.

Q6. What opportunities exist in India’s road freight sector?

The growth of e-commerce, investments in green technologies, and the expansion of logistics infrastructure present significant opportunities for the road freight market.