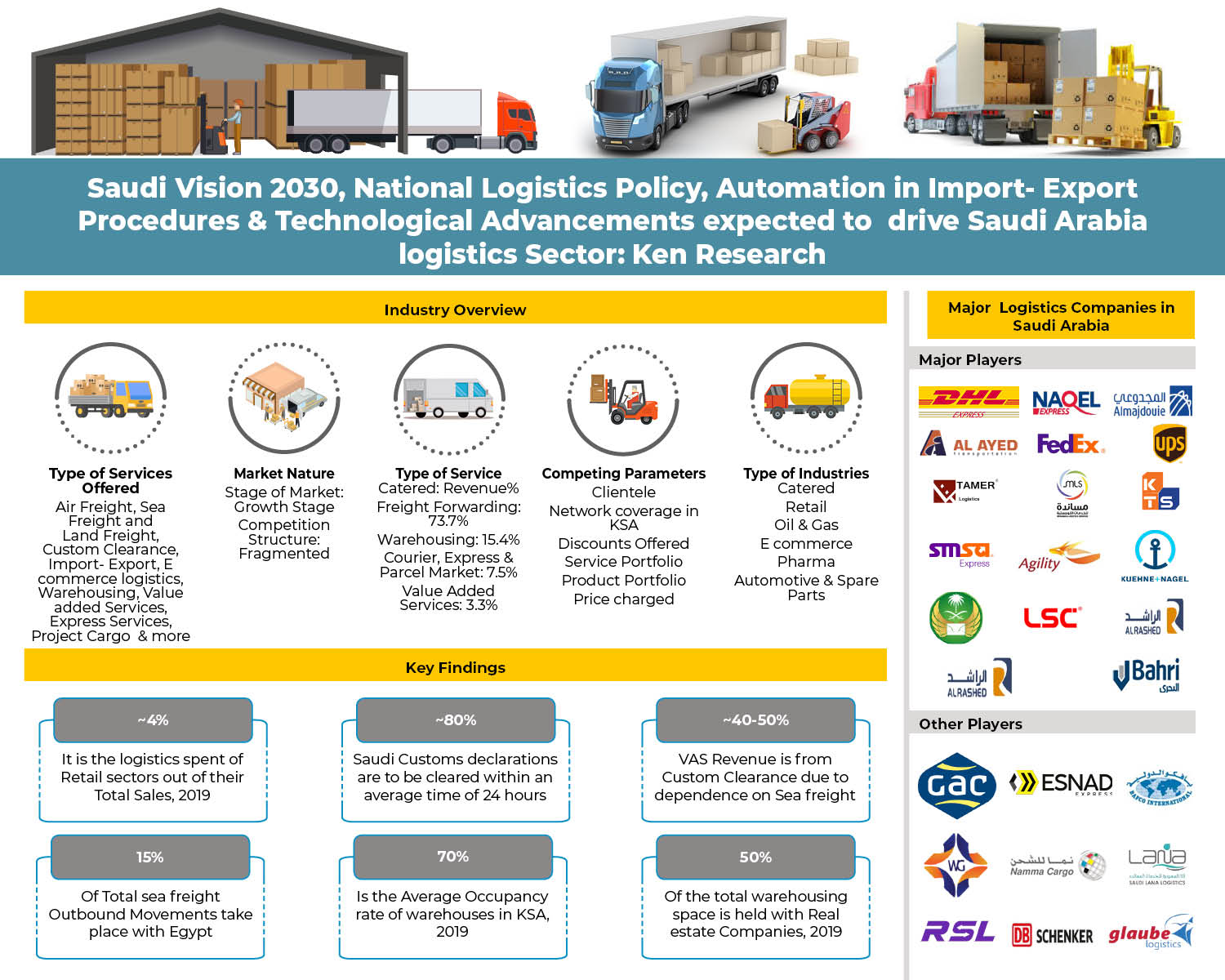

KSA Freight Forwarding Market Overview

Given its advantageous position, the logistics business in Saudi Arabia is one of the world’s main logistics markets, second only to the UAE, and is predicted to be the next trans-shipment hub for Asian, African, and European countries. Due to the high level of business accessibility and the industry’s ranking of 89th in the world, growth in the sector has been promoted.

The nation had a shift in purchasing behavior during the COVID-19 epidemic, moving away from traditional hypermarkets and supermarkets to internet retailers for necessities like groceries and other things. In the long run, this is anticipated to expand the market and enhance competition for logistics players in the nation in terms of quicker delivery and a seamless client experience.

Report Analysis

According to the research report, “Competition Benchmarking of Top Logistics Players in KSA in Transportation, Warehousing, 3PL, International Express, Domestic Express, Automotive, Pharma, Oil and Gas, and Retail Logistics” asserts that throughout the anticipated term, the increase in the e-commerce sector, which directly drives the logistics and transportation sector, will cause the Saudi Arabian logistics market to rise quickly. The government has also worked to strengthen the legal foundation in order to encourage this expansion and guarantee the logistics industry’s long-term viability.

A dominant position in oil exports and dependence on imports for all essential products means that sea and land freight movements dominate the business. The US, Europe, and Asia are the three main trading partners of the nation. Usually, the UAE, Bahrain, Jordan, and Egypt trade a lot of land freight. Since it is so expensive compared to other modes, air freight is typically employed for express shipments. The KSA also has a robust market for warehousing, where real estate players rent out their space to logistics firms and captive players for extended periods of time. Due to their dense populations and proximity to seaports, Riyadh, Jeddah, Dammam, and Al Khobar have the highest concentration of warehouses. The expansion of Last-Mile delivery and the nation’s e-commerce sector are the driving forces behind the courier, express, and parcel market.

Request for Free Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=MzczMzE3

Competitive Environment

Freight forwarding, contract logistics (warehousing), and express delivery are three service sectors on which the competition in the logistics market in KSA can be separated. Domestic and international firms with strong brands in the global market for their high-quality services, such as Bahri Logistics, Kanoo Terminal, Kuehne + Nagel, DB Schenker, DHL, and Agility, were found to be dominating in the air freight and sea freight sectors. Local domestic carriers dominate the road freight market in terms of fleet types, truck counts, prices, delivery schedules, and other factors. The Saudi Arabian logistics market is dominated by NAQEL express, SMSA Express, Saudi Post, ESNAD express, and other companies, however, the international express market is dominated by large international firms like DHL, FedEx, and others.

KSA Digital Freight Forwarding Market Future Outlook

The Saudi Arabian logistics industry is anticipated to expand in the coming years, with the exception of 2020, when a brief shutdown that affected import and export movements by all modes caused a decline that is anticipated to recover in the forecasted period. In order to attract customers by offering high-quality services, improving customer experiences, and enhancing service quality, logistics companies are expanding and upgrading new technologies like RFID tags, WMS, Fleet Management Software, Blockchain, and ASRS at affordable costs. Given the anticipated increase in medical product requirements following COVID-19 and the expanding penetration of e-commerce in the nation, the pharmaceutical logistics market and the e-commerce logistics segment are predicted to drive growth in the near future.

Related Reports

Follow Us

LinkedIn | Instagram | Facebook | Twitter | YouTube

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

+91-9015378249