Overview:

NPLs (Non-Performing Loans) by Saudi banks as a percentage of total gross loans have witnessed steady rise over the last five years thereby creating market opportunity for debt collection companies catering to the financing segment.

Debt collection companies strongly prefer to resolve debt collection matters without going to court. However, all collection companies have partnered with law firms to resolve cases through litigation.

To learn more about this report Download a Free Sample Report

Market:

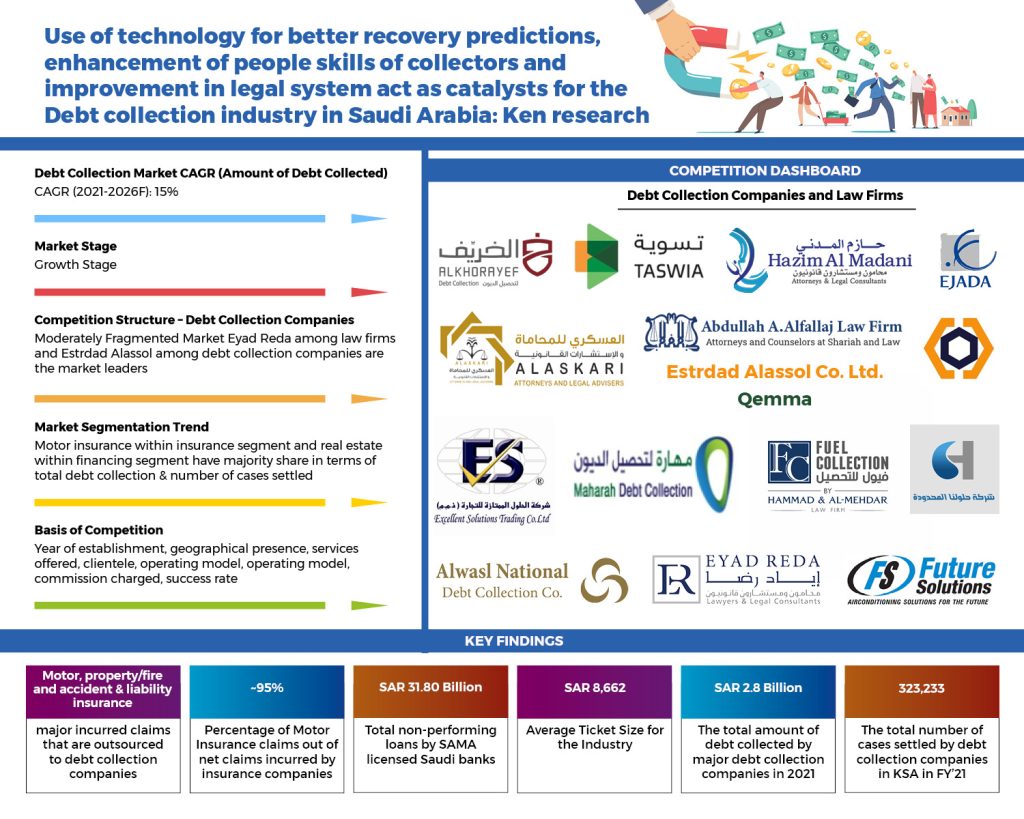

The Debt Collection market in KSA is expected to grow at a double digit CAGR between FY ’21 and FY ’26 with new entrants facing fierce competition from the existing major players in the market.

Motor Insurance claims has the highest percentage share among net claims incurred by insurance companies in KSA. The major source of revenue for debt collection companies is the commission charged on recovered amount.

By Segments

Financing segment accounted for majority of debt collected, however, the non-finance segment has major share in total number of cases settled. With a low-ticket size of SAR 4,000, Non-finance segment have major share in total number of cases settled. With high ticket size of SAR 18,000, financing segment has low share in total cases settled.

By Geography

Cities of Riyadh, Jeddah and Dammam are the major geography from where debt is collected in KSA.

By Type of Firm

Debt Collection Firms have majority share in terms of amount of debt collected as well as number of cases settled as compared to Law firm cum Debt Collection Companies.

By Age of Firm

Relatively mature companies (12 years – 17 years) have highest share in debt collection as well as cases settled; likely due to recurring contracts from existing clientele.

By Sub-segmentation of Insurance

Motor insurance within insurance segment have majority share in terms of total debt collection & number of cases settled.

By Sub-segmentation of non-Finance

Telecommunication services and Utilities are the major sub-segments for debt collection within the non-finance segment.

By Sub-segmentation of Finance

Real estate within non-finance segment has majority share in terms of total debt collection & number of cases settled.

Competitive Landscape

The market is fragmented with presence of a large number of debt collection companies and law firms. The existing players in the market are majorly headquartered in the cities of Riyadh, Jeddah and Dammam. These companies vary largely on the basis of collection agents, Lawyers, number of employees. Apart from debt collection services, companies are also providing credit reporting/business advisory as value-added services to meet client requirements.

There exists a moderate threat of new entrants as they have to overcome various challenges like licensing requirements, capital requirements, access to a network of collection agents and lawyers, etc. However, as offerings of existing players are not much differentiated, new players can enter the market with competitive pricing and spending on marketing campaign.

Request for Sample Report @

https://www.kenresearch.com/sample-report.php?Frmdetails=NTk2MDk2

What Is the Future of KSA Debt Collection Market?

The Debt Collection Market in Saudi Arabia is anticipated to grow at a positive double digit CAGR for the period FY’21-FY’26F.

Future Trend: Artificial Intelligence and Machine Learning are enabling better recovery predictions and ongoing case management. Moreover, AI also helps with regulatory compliance. AI-based collections management software is bound to find higher usage in the coming years.

For more information on the research report, refer to below links:

Establishing A Debt Management Office in KSA

Related Reports

Contact Us:

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249