Focused on influx of AI technology along with growing demand for financial inclusion and affordability in financial planning.

Increasing Digitalization: The increase in digitalization has completely transformed the human advisory process into digital solution platforms known as Robo-Advisors, which has also given the next digital generation a chance to establish more elaborate solutions to model customer’s preferences & enable higher customization of investment portfolio in a fully automated process and with the large numbers of HNWIs and a relatively young and tech-savvy population, GCC countries are ideally placed to foster the development of Robo-advisory services. Digitalization has also made the Robo-Advisory platforms easy to use, simple & straightforward which has reduced the stress making it easily accessible than other wealth management advisors.

Minimal Investment: With zero or near to zero minimum balance technology-enhanced Robo-Advisors are accessible in the market which makes it a cost-efficient investment solution and providing a easier way to secure a small investment from the banks as well. Robo-advisors are Low-cost investment platforms making it easy for KSA residents to save money and they are also cheaper as compared to traditional (human) financial advisors which typically charge more than 1% per year of AUM whereas Robo-advisors charge less than 1% per year of assets under management.

Changing Investor Preference: Digital technology has changed customer expectations at a rapid pace over the past five years. Consumers today prefer the convenience of managing everything online, primarily the reason for digital transformation within the global financial services industry. Nearly 40% of firms identified accessibility as the main investor driver for using Robo-Advice services which has changed the investor preference, making it an attractive market for the investors. Furthermore, the acceleration of digital investment advice through scalable robo-advice solutions has also forced the traditional wealth management firms to also look towards the robo-advisory solutions.

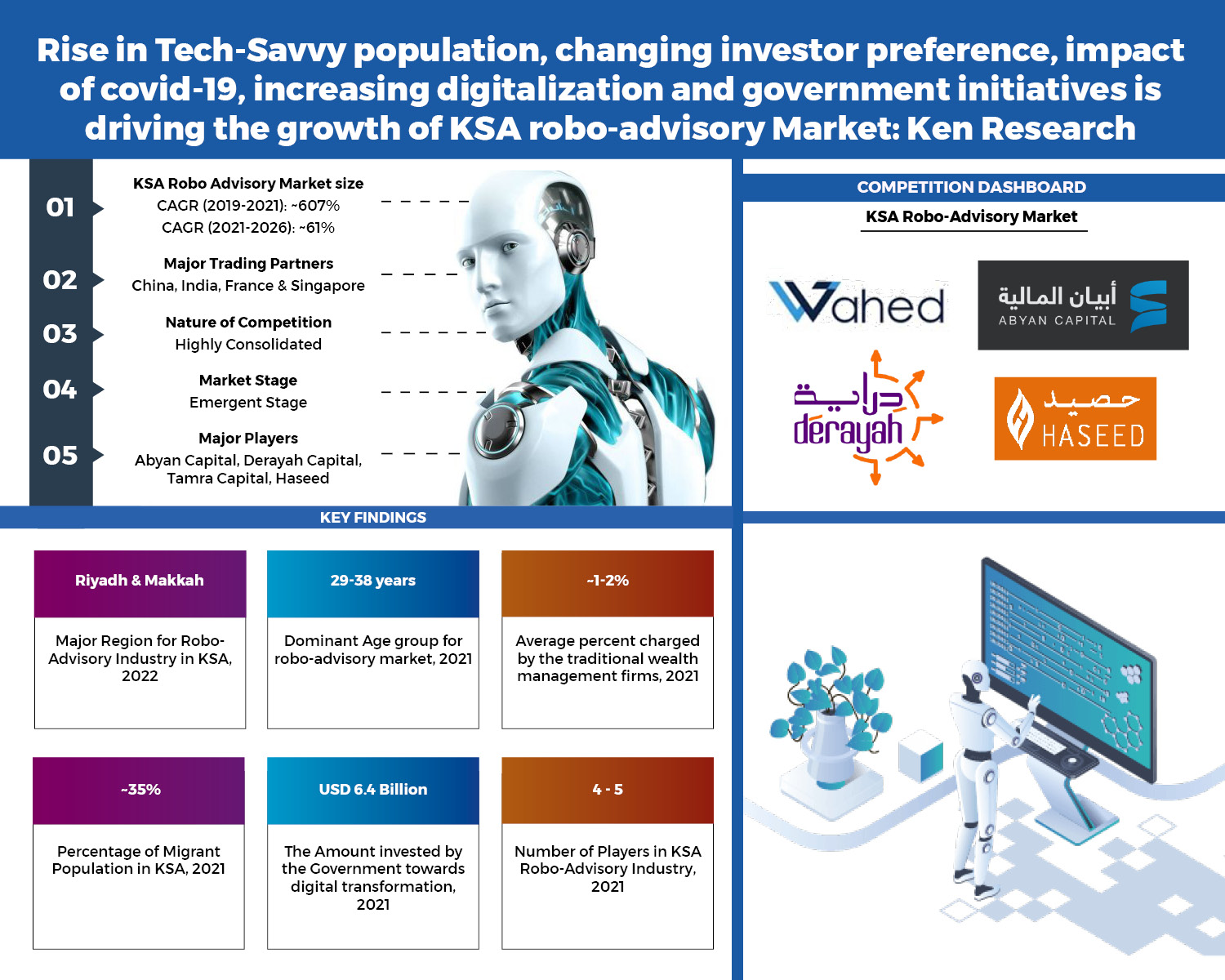

Analysts at Ken Research in their latest publication “KSA Robo-Advisory in Wealth Management Market Outlook to 2026F– Driven by influx of AI technology along with growing demand for financial inclusion and affordability in financial planning” by Ken Research observed that KSA Robo Advisory market is in the nascent phase. The Increasing Digitalization, requirement of minimal investment, impact of covid-19 and change in investor preference, are some of the factors that has contributed to the KSA robo-advisory market growth. It is expected that KSA Robo-Advisory Market will grow at a CAGR of ~52% for the 2022-2026F forecasted period.

Key Segments Covered

KSA Robo Advisory Market:

- By Type (by Revenue), 2022 & 2026F:

- Hybrid Robo Advisors

- Pure Robo Advisors

- By End-User (by Revenue), 2022 & 2026F:

- Retail Investor

- High Net Worth Individuals

- By Age-group (by Revenue), 2022 & 2026F:

- 19-28 years

- 29-38 years

- 39-45 years

- 45+ years

- By Region (by Revenue), 2022 & 2026F:

- Riyadh

- Makkah

- Eastern Region

- Others

Key Target Audience

- Government and Institutions

- New Market Entrants

- Investors

- Wealth Management Companies

- Robo-Advisory Companies

- Investment Banks

- Investors

Get the Free Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=NTk2MTkz

Time Period Captured in the Report:

- Historical Period: 2019-2021

- Base Year: 2022

- Forecast Period: 2022 – 2026F

Companies Covered:

- Abyan Capital

- Derayah Capital

- Tamra Capital

- Haseed

Key Topics Covered in the Report:

- KSA Country Overview

- KSA Population Analysis

- KSA Wealth Management Market Overview

- Ecosystem of KSA Robo-Advisory in Wealth Management Market

- Timeline of Major Players in KSA Robo-Advisory in Wealth Management Market

- Business Cycle and Genesis of KSA Robo-Advisory in Wealth Management Market

- Value Chain Analysis/ Existing Business Model

- KSA Robo-Advisory in Wealth Management Market Size

- KSA Robo-Advisory in Wealth Management Market Segmentation by Type and End User, 2022

- KSA Robo-Advisory in Wealth Management Market Segmentation by Region, 2022

- End User Profiling by Age of Customer, 2022

- Decision Making Parameters of End Users in KSA Robo-Advisory in Wealth Management Market

- Customer Pain Points in KSA Robo-Advisory in Wealth Management Market

- Key Factors Influencing Robo-Advisory Services Purchasing Decisions and Cost Components

- Porter’s Five Forces Analysis of KSA Robo-Advisory in Wealth Management Market

- Growth Drivers of KSA Robo-Advisory in Wealth Management Market

- Trends and Developments in KSA Robo-Advisory in Wealth Management Market

- Issues and Challenges in KSA Robo-Advisory in Wealth Management Market

- Government Rules and Regulations in KSA Robo Advisory in Wealth Management Market

- Covid-19 Impact on KSA Robo Advisory in Wealth Management Market

- Competition scenario of key players based on Revenue, 2022

- Cross Comparison of Major Players in KSA Robo-Advisory in Wealth Management Market

- Outlook and Future Projections for KSA Robo-Advisory in Wealth Management Market

- Analyst Recommendations

For more insights on the market intelligence, refer to the link below: –

KSA Robo-Advisory in Wealth Management Market Outlook to 2026F: Ken Research

Related Reports: