What Is The Current Potential Of Singapore International Remittance Market?

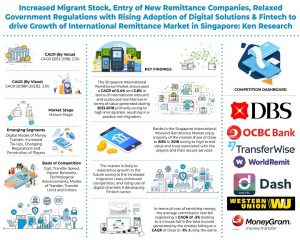

Remittances have emerged as a key factor in the global development plan. Remittances are defined as cross-border, person-to-person payments of relatively low value. Not all migrants send remittances, but majority of them sent. Some migrants send funds regularly, whereas some send only on special occasions or when emergencies rise back home. During the last 5 years, the remittance market has been growing towards digitalization, increased channels and diversified services. The transaction value of remittances increased from SGD ~ million in 2013 to SGD ~ million in 2018. The CAGR recorded for the review period was ~%. The transaction volume for the market during the year 2013 was ~ million which rose to ~ million recording a CAGR of ~%.

The major stakeholders in the market have been banks and money transfer operators; although there are retailers and mobile wallets too, but are not frequently used. Prominent business strategies adopted by major players include forming an extensive network, new service launches, service innovation and improved reach, with providing the remittance service at a lower cost and at a faster speed. Also, the major players have been focusing on digital and mobile remittances and Fintech too. According to UNICEF, “Singapore has a migrant population of more than ~ million, which is around 20% of the total population. The migrant population is mainly from South-Asian countries, like Malaysia, Indonesia, China, India and Hong-Kong, and the Pacific.”

How Did Singapore International Remittance Market Evolve?

Out of the total population of ~ million in 2017, more than ~ million people have migrated to Singapore, and out of ~ million resident population, more than ~% are not natives of Singapore. With an unemployment rate of less than ~%, the plethora of opportunities in Singapore are not being overlooked by international labor market, and this is evident enough in the migrant stock data released by UNICEF. According to the report, total population in the age category 25-49 is dominated by foreign-born (males and females); more than ~% of the total migrant stock is concentrated in this age group. This migration trend, being complimented by strong GDP growth, has clearly engendered an Outward International remittance of enormous amounts, reaching a record high in 2018. The majority of this outward remittance has been to Pakistan, Malaysia, China, Indonesia and India. These are also the countries of origin of majority of migrant stock in Singapore. Recent developments in Mobile Wallets and Mobile applications of banks and MTOs, and the increased use of such technology, has made sending and receiving money globally fast and secure. Moreover, the number of Mobile internet subscribers has also seen a positive trend in the last six years. These macro economic factors have led the evolution of Singapore international remittance market. The market is now being fuelled by increased migration, better legislative environment in form of relaxed policies, increased awareness towards digitalized remittance services and developments in digital payment networks & Fintech space.

What Is The General Overview Of The International Remittance Sector In The Region?

Singapore International Remittance Market has been analyzed to be concentrated for banks whereas moderately fragmented for non-banking institutes in 2018. The market has been positioned to be at mature stage. The market comprises of banks, money transfer operators, mobile wallets, postal networks as major entities wherein it is majorly dominated by Banks and MTOs. Prominent business strategies adopted by major players to position themselves in the market include forming an extensive network & improved reach, new services launched & service innovation and better pricing & handy/transparent operations offered. The market has been fuelled by increased migration, better legislative environment in form of relaxed policies, increased awareness towards digitalized remittance services and developments in digital payment networks & Fintech space. In the next 5 years, players would be expanding through acquisitions, tie-ups, increased digital modes of money transfer like mobile applications and M-wallets, lowered cost of sending money and faster transfer speed. The proportion of inbound remittance in total remittance declined registering a CAGR of ~% while outbound penetration increased at around ~% during 2019 in terms remittance value. In terms of volume of transactions, outbound transaction increased by almost triple the CAGR registered by inbound transactions during the review period. There is lack of presence of m-wallets however, in the recent years; banks have started partnering with these m-wallet companies.

For More Information on the research report, refer to below link:

Singapore International Remittance Market

Other Related Reports

Contact Us:

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249