The publication titled ‘UAE Online Insurance Industry Outlook to 2024 – Driven by Customer Uptake, Ease for New and Renewal Policy Convenience with Insurance Aggregators’ undertakes a comprehensive analysis of the insurance industry in UAE, product-wise buying patterns of insurance among the population, traditional distribution channels including brokers, banks, agents, direct channels, etc and further explore the under-penetrated potential of aggregator led online insurance distribution. Following the path of European economies with high penetration of online insurance (>60%), research answers the question if aggregators are here to stay in UAE. Analysts have also depicted the general business model, end to end online buying process, Typical Organizational Structure, and Technology stack integrated by such firms in the platforms. With an extensive focus on Competitive benchmarking among major Aggregators including Yallacompare, Souqalmal, Bankonus, and PolicyBazaar UAE, the research concludes with some key recommendations for firms to focus on profitability, expanding the model to the peer GCC countries, increased emphasis on other banking products of loans, credit cards, etc to ensure sustainable growth in the coming years.

Where does the Insurance Industry stand today?

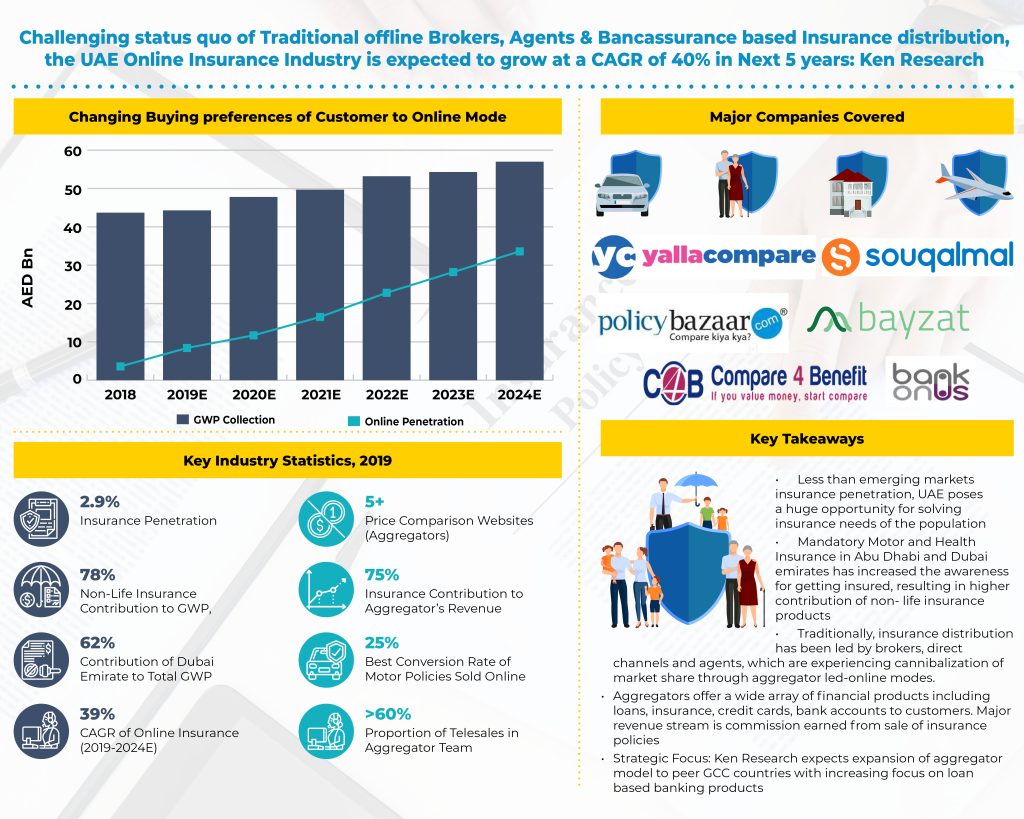

GWP collection stood at $12Bn, majorly led by growth in non-life insurance products of Health and Motor. Insurance of Persons and Fund Accumulation contributed 28% to total GWP collection. While UAE is ahead among the peer GCC countries in terms of insurance penetration of 2.9%, it still lags behind the average insurance penetration of emerging countries which stands at 3.2% and Global average of 6.1%. Mandatory insurance requirements of Motor across UAE coupled with Health Insurance in Abu Dhabi and Dubai has contributed to raising awareness among people to protect their risks.

To learn more about this report Download a Free Sample Report

Traditional Distribution Channels & Viability of Aggregator led Online Model

Challenging the established dominance of Brokers, Banks and Agents are not easy for Aggregators as incumbents generate ~99% of the total premium collection in 2018, as per the data released by Insurance Authority of UAE. However, aggregators are stepping up due to the changing customer preferences towards online, price comparison led to buying behavior. Relying on commission-driven income and a high one-time cost of technology building for offering multiple banking products, aggregator’s model is highly scalable to peer GCC countries, thereby ensuring sustainable growth by becoming a one-stop solution provider.

Are aggregators here to stay?

Primarily, targeting kin to commodity ‘Motor Insurance’ products, aggregators have built-in AI-driven algorithms and platforms capable of generating quotes within a minute and delivering policies in the e-mail within 60 minutes. This has allowed customers to get away with the tedious process of submitting documents offline and foster confidence owing to a lack of information asymmetry. Ken Research believes online insurance could cannibalize the share of brokers and banks and contribute >10% of total GWP collection by 2024.

Time Period Captured in the Report: –

Historical Period – 2014 -2019

Forecast Period – 2019 – 2024E

Companies Covered:

Yallacompare

Souqalmal

Bankonus

PolicyBazaar UAE

Compare4benefits

Insurancemarket.ae

Bayzat

Key Topics Covered in the Report: –

Socio Demographic and Economic Outlook of UAE

Insurance Industry in UAE basis Products, Distribution Channel

Decoding Penetration of Online Insurance with a special focus on Aggregators

Business Model of Aggregators (Revenue Streams, Organizational Structure, End to End Buying Process, Technology Stack)

Market Size of Insurance Aggregators basis Revenue and Aggregators

Competitive Landscape among major Aggregators (Cross comparison matrices, strengths, weakness and company profiles)

Future Outlook of Insurance Industry

Potential of Insurance Aggregators in UAE

Key Analyst Recommendations

For More Information on the research report, refer to below link: –

UAE Online Insurance Market Growth

Related Reports by Ken Research: –

India Online Insurance Outlook to 2019 – Driven by Internet Growth and Web Aggregators Industry

Contact Us: –

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249