The world of wealth management plays a crucial role in helping individuals and families navigate their financial journeys and secure their futures. The wealth management market, encompassing services that assist clients in growing, preserving, and transferring their wealth, is a complex and dynamic sector. This blog delves into the current state of the wealth management industry, analyzing its size, segmentation, key players, trends, challenges, and future outlook.

A Flourishing Market Driven by Rising Affluence

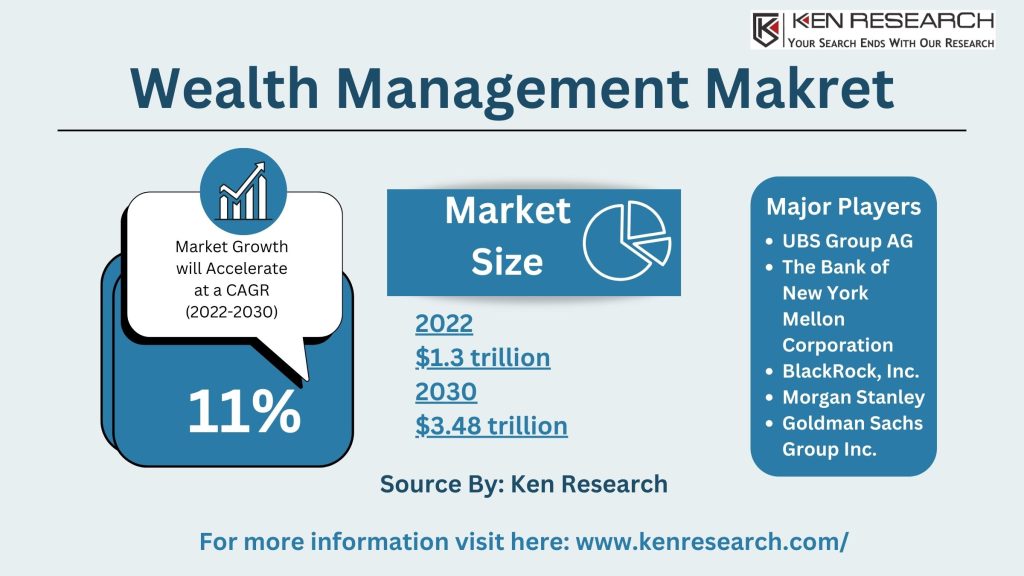

The wealth management market is experiencing significant growth. According to a report by Ken Research, the global wealth management market size reached a substantial $1.3 trillion in 2022 and is projected to reach a colossal $3.48 trillion by 2030, boasting a healthy CAGR (Compound Annual Growth Rate) of 11%. This growth is fueled by several factors:

- Rising Affluent Population: The global population of high-net-worth individuals (HNWIs) is increasing steadily, creating a growing demand for wealth management services.

- Increasing Financial Complexity: Navigating complex financial instruments and investment strategies necessitates professional guidance offered by wealth management firms.

- Shifting Demographics: The wealth transfer from baby boomers to millennials presents opportunities for wealth managers to cater to the unique needs of younger generations.

Market Segmentation: Tailored Solutions for Diverse Needs

The wealth management market segmentation based on various factors, reflecting the diverse needs of clients:

By Client Segment:

- High-Net-Worth Individuals (HNWIs): This segment caters to individuals with investable assets exceeding a certain threshold (typically $1 million or more). HNWI wealth managers provide personalized investment advice, estate planning services, and other sophisticated financial solutions.

- High-Income Earners: This segment focuses on individuals with significant income levels who may not yet meet the HNWI threshold but still require wealth management guidance.

- Mass Affluent Investors: This rapidly growing segment caters to individuals with lower levels of investable assets but aspire to accumulate wealth and require basic wealth management services.

By Service Type:

- Investment Management: Wealth managers create and manage personalized investment portfolios for clients, considering their risk tolerance and financial goals.

- Financial Planning: This service provides comprehensive financial guidance, including budgeting, tax planning, retirement planning, and estate planning.

- Family Office Services: This caters to ultra-high-net-worth individuals and families, offering a wider range of services like philanthropy management and business succession planning.

By Distribution Channel:

- Traditional Wealth Management Firms: These established institutions offer a comprehensive suite of wealth management services with dedicated advisors.

- Robo-advisors: These automated online platforms provide low-cost, algorithm-driven investment management solutions, appealing to some mass affluent investors.

- Hybrid Wealth Management Models: These combine the human expertise of traditional advisors with the technology-driven efficiency of robo-advisors, offering a blend of personalized service and cost-effectiveness.

Take a look at:Wealth Management Market $71.4 Trillion: Size, Growth, and Future Outlook

Wealth Management Platform Market: Empowering Efficiency

The wealth management platform market is a rapidly growing segment within the industry. Wealth management software streamlines operations for advisors, including portfolio management, client communication, and regulatory compliance. This technology empowers advisors to provide more efficient and personalized service to their clients.

Market Analysis: Trends Shaping the Future of Wealth Management

Several wealth management market trends are shaping the future are:

- Personalization at Scale: Wealth managers are increasingly leveraging technology to personalize investment strategies and client communication while maintaining scalability.

- Focus on Sustainable Investing: Growing demand for environmentally and socially responsible investments is prompting wealth management firms to offer sustainable investment options.

- Rise of Fintech and Artificial Intelligence (AI): Technological advancements are being integrated into wealth management platforms, offering more sophisticated investment analysis and client service automation.

- Digital Transformation: Integration of technology for enhanced client experience, automated tasks, and improved efficiency. Wealth management software is evolving to address these needs.

Wealth Management Market Major Players and Industry Dynamics

The wealth management industry boasts a mix of established financial institutions and innovative technology-driven startups:

-

- UBS Group AG

- The Vanguard Group, Inc.

- BlackRock Inc.

- Morgan Stanley

- Goldman Sachs Group Inc.

These are top players in wealth management market offer comprehensive wealth management services, while fintech companies are disrupting the industry with digital platforms and automated solutions. Mergers and acquisitions are also prevalent in the wealth management space, shaping the competitive landscape.

Opportunities and Challenges: Embracing Transformation

The exciting opportunities in wealth management industry are :

-

- Growing Affluent Population: The rising number of HNWIs and UHNWIs globally creates a strong demand for wealth management services.

- Technological Advancements: Wealth management platforms, big data analytics, and artificial intelligence (AI) are revolutionizing the industry, offering personalized and efficient solutions.

- Emerging Markets: Developing economies with growing affluence present significant growth potential for wealth management firms.

However, some of the wealth management market challenges:

-

- Regulatory Changes: Stringent regulations and compliance requirements can pose challenges for wealth management firms operating across borders.

- Fiduciary Duty: Ensuring clients’ best interests are prioritized at all times is a paramount responsibility and requires a strong ethical framework.

- Cybersecurity threats: Protecting client data and mitigating cybersecurity risks are crucial aspects of wealth management in the digital age .

Market Forecast and Future Outlook

The wealth management market forecast predicts continued robust growth. Rising disposable incomes, increasing financial literacy, and technological advancements are expected to be the key drivers. The wealth management market report suggests a future where wealth management services are accessible and relevant to a broader spectrum of individuals, regardless of their wealth level.

Conclusion: A Collaborative Future for Wealth Management

The future of wealth management lies in collaboration between established firms and innovative fintech players. By embracing technology, prioritizing client education, and offering sustainable investment options, the industry can create a more inclusive and prosperous future for all.

You can also read about :Forecasting the Future of Wealth Management Market: Trends, Analysis, and Revenue