Malaysia Online Insurance Industry Overview:

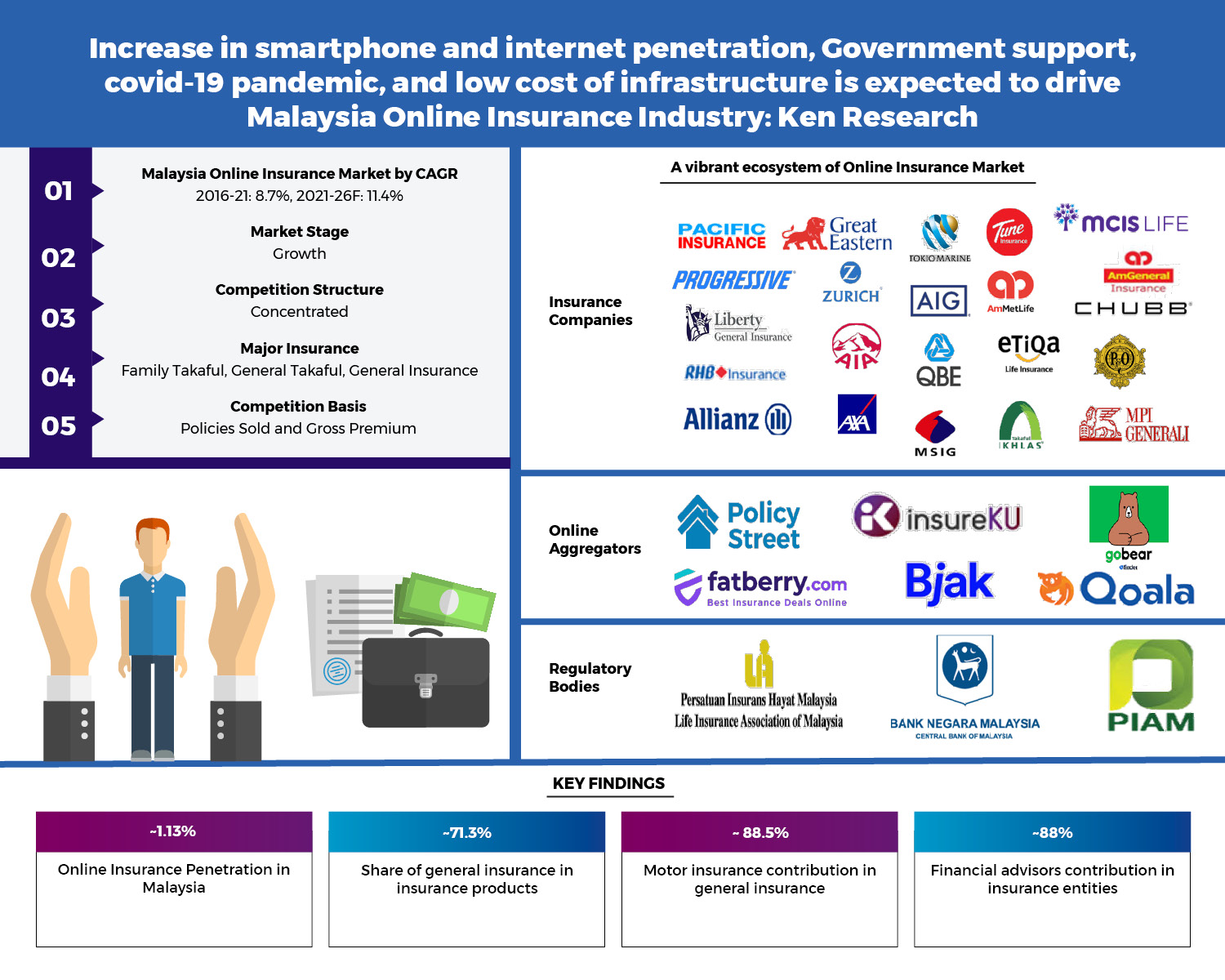

Increasing Internet and Smartphone penetration, low infrastructural cost and covid-19 pandemic have collectively influenced the demand of Online Insurance users in the country. Players in Insurance industry are aiming to provide online services to cater the untapped and under exploited market.

Medical inflation is increasing at more than 10% since 2015, leading to increasing demand for health insurance providers. Covid-19 also plunged the demand and penetration in the health insurance segment with double digit CAGR seen from 2019 to 2020, the highest increase in over the past 5 years. Malaysia’s life insurance industry underwent digitization because of the COVID-19 epidemic. The restrictive measures imposed in Malaysia provided an opportunity for insurers to switch to a digital mode of operations.

Motor Vehicle registration is growing at a constant rate, with more than 50 products launched in the market in 2019. This has increased the need for motor vehicle insurance providers in Malaysia.

Travel Insurance constitutes very high proportion in the online insurance segment, with Most of the travel insurance are sold online along with the travel packages or bookings. Online travel agencies tie up with companies to provide insurance for their users. Huge investment are made in insurtech companies with technological advancement in the form of automation and personalization, dominated the insurance landscape.

Increasing mobile penetration gave high upside potential to the online insurance market with Malaysia having 89% internet users in 2020, and growing at a CAGR of 5% since 2016 showing opportunity for business to divest in online insurance segment. Multiple marketing and business strategies are implemented involving cutting insurance time from 14 days to 1 hour, thus reducing waiting time for the buyers.

The report titled “Malaysia Online Insurance Market Outlook to 2026F: Driven by a growth in demand for insurance at greater convenience and lesser cost in the country” by Ken Research suggested that the Malaysia Online Insurance market is expected to grow significantly owing to increasing government support and covid-19 pandemic. Covid-19 drive the growth of Insurance Industry with the increase in online users and people’s preference towards avoiding physical contact and substantial increase in the health demand for the users. Instead of a one-size fits-all approach, insurer’s offers personalized or customized insurance products through the digital insurance process, in order to satisfy the needs of all types of clients. Online sales of insurance has removed the intermediary between the firm and the policyholder. This cuts down cost for both the insured as well as the insurer. The convenience and ease of use offered due to shifting of the industry online makes it a preferred choice for people looking to purchase insurance currently. The experience of being able to purchase insurance from the comfort of one’s own home drives them towards online insurance.

Key Segments Covered in Malaysia Online Insurance Industry

Malaysia Online Insurance Market

- By Product type of Insurance basis Gross Premium

- Life Insurance

- Family Takaful

- General Takaful

- General Insurance

- By Product type of General Insurance basis Gross Premium

- Motor Insuranc

- Medical & Health

- Employer’s liability

- Personal accident

- By Type of Entity basis Gross Premium

- Captive Players

- Aggregator Players

- Financial Advisors

- By Region basis Gross Premium

- Penang

- Johar

- Klang Valley & Selangor

Request For Free Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=NTk2MDQ4

Key Target Audience

- Insurance players

- Online Insurance Captive players

- Online Insurance Aggregators players

- Insurance Technology provider

- Insurance users

- New Entrant in Online Insurance space

- Associated or affiliated Banks with Insurance entities

- Regulatory Bodies for Insurance entities

Time Period Captured in the Report:

- Historical Period: 2016-2021

- Forecast Period: 2022-2026

Emerging Companies in Malaysia Online Insurance Sector

Companies Covered:

Online Insurane Aggregators

- Policy Street

- Bjak

- Qoala

Online Insurance Captive Players

- Liberty Insurance

- Axa Affin Insurance

- eTiQa Insurance

- AIA Malaysia

- Takaful Ikhlas

- Tune Insurance

- Zurich Insurance

- Chubb Insurance

- Allanz Malaysia Berhad

- FWD Takaful

Key Topics Covered in the Report

- Overview of Malaysia Online Insurance Industry

- Startups in Malaysia Online Insurance Sector

- Country Overview of Malaysia Online Insurance Industry

- Malaysia Online Insurance Market Overview and Genesis

- Malaysia Online Insurance Market Segmentations

- Industry Analysis of Malaysia Online Insurance Market

- Snapshot on Online Aggregators in Malaysia

- Competition Analysis of Malaysia Online Insurance Market

- Outlook and Future Projections for Malaysia Online Insurance Market

- Research Methodology

Related Reports

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

+91-9015378249