March 2022 | India News

- Demand for Used Two Wheelers is expected to increase as lockdown due to COVID 19 is easing further, but supply for second hand two wheelers has also reduced, owing to people holding on to their two wheelers for a longer period.

- Entry of OEM’s into the used two wheeler market is expected to drive the demand further, as the market becomes more organized.

Increasing Demand for Luxury Motorcycles: The demand for luxury, high end used two wheelers is increasing owing to the budget constraints and rising aspirations of young consumers. Supporting this trend, luxury 2W OEM’s such as BMW and Ducati are entering the used two wheeler market on their own, with certified vehicles and easy financing options to increase their reach and target new consumers. As disposable income increases, it is expected that more luxury used two wheelers will enter the market, driving the demand. This will also ensure a slight marginal increase in the organized segment in the industry.

India Used Two Wheeler Market Overview

Increased focus on Quality: As market awareness increases, buyer’s decision making process has transitioned from pricing to product quality along with pricing.

Quality check parameters include Paperwork, Vehicle accessories check, Engine Capacity, Bodywork including fairings, windshields and bags, Front and rear fenders, Road test, Paint, Tyres, Breaking System and others. Online platforms helping consumers take informed decisions by providing product rating & user reviews, on road prices in all cities and with respect to dealers, regular publishing of article & blogs.

Internet-based sales to dominate the market: The internet has expanded from just being a tool to check updates over social media or emails to purchase and sales of goods as well. E-commerce industry is a booming sector and, in this sector, the pre-owned vehicle sale, as well as, purchase is a profit-making business. Moreover, in purchase of used bike online platforms, the popularity for consumer to consumer have escalated. In 2020, CredR, a used bike sales platform announced delivery of second-hand bikes to doorstep of consumers.

Rising Aspirations of Young Population: Increased urbanization & standard of living there has been a shift in consumer preferences with a rising need for a personal vehicle. However, consumers in low income bracket prefer used bikes/scooters. Increased working age population1 (49.25% in 2019) now prefer travelling on their own against crowded public transport. Therefore in most cases they choose to buy a second hand vehicle before buying a new one. Millennial population often fascinated with Super/Imported bikes opts for used imported ones owing to affordability constraints.

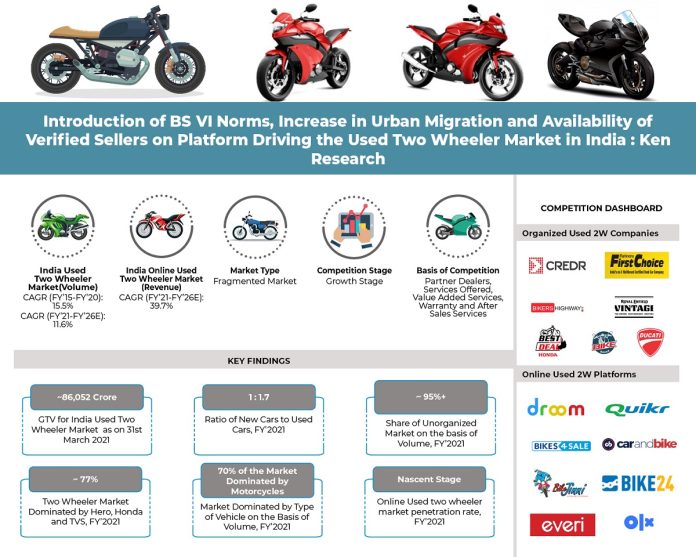

The report titled “India Used Two Wheeler Market Outlook to 2026 (Second Edition) – Convenient Financing Options and Emergence of Online Marketplace Platforms supporting Market Growth” by Ken Research suggested that the used two wheeler market is expected to grow at a double digit positive CAGR. Rising Aspirations of young consumers along with increasing in demand from Tier II & Tier III cities is driving the used two wheeler market in India. The used two-wheelers sales volume in India is expected to grow over the next few years owing to introduction of new two wheeler variants along with the rising aspirations of low and middle income consumers in the country.

Key Segments Covered in India Used Two Wheeler Market, FY’2021

- By Modification

- Stock Piece

- Customized

- By Type of Bike

- Motorcycles

- Scooters

- By Engine Capacity

- 100CC-110CC

- 125CC-135CC

- 150CC-200CC

- By Replacement Cycle

- 0 years – 2 years

- 2 years – 4 years

- 4 years – 5 years

- 5 years – 6 years

- 6+ years

- By Financing

- Financed

- Non Financed

Request For Free Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=NTE1MDY2

Key Target Audience

- Two Wheeler OEM’s

- Two Wheeler Dealers

- Online Portals (Aggregators)

- Marketplace Online Platforms

- Online 2 Wheeler Classified Portals

- E-Commerce & Hyperlocal Companies

- Private Equity Investors

Time Period Captured in the Report:

- Historical Period: FY’2015 – FY’2021

- Forecast Period: FY’2021 – FY’2026E

Companies Covered:

Organized Used 2W Companies

- Honda Best Deal

- CredR

- Mahindra First Choice

- Bike Bazaar

- Bikers Highway

- Royal Enfield Vintage

- Ducati

- Suzuki Best Value

Online Used 2W Platforms

- Droom

- Quikr

- Olx

- Bikes4Sale

- CarandBike

- Bike Jinn

Key Topics Covered in the Report

- India Used Two Wheeler Market Future Outlook

- Market size of India online used two wheeler market

- Value chain in India used two wheeler market

- Market segmentation of India used two wheeler market on the basis of market structure, stock piece & customized vehicle, distribution channels, source of

- Manufacturing, type of two-wheeler, engine capacity, average ownership period, by manufacturer, body type, certification and financed & non-financed vehicle.

- Trends and Developments in India used two wheeler market

- Growth Drivers and Restraints in India used two wheeler market

- SWOT analysis in India used two wheeler market

- Pre-Requisites to Enter the India used two wheeler market

- Government Regulations in India used two wheeler market

- Major players and their business models

- Customer Profile in India used two wheeler market

- Analyst Recommendations

Related Reports

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

+91-9015378249