ATM managed services is detailed collection of services delivered to financial institution, banks and several other business entities installing ATM machines. Such services comprise ATM service and repair, electronic journal & content management system, cash management, transaction processing, ATM deposit automation, software maintenance, and cash reconciliation services.

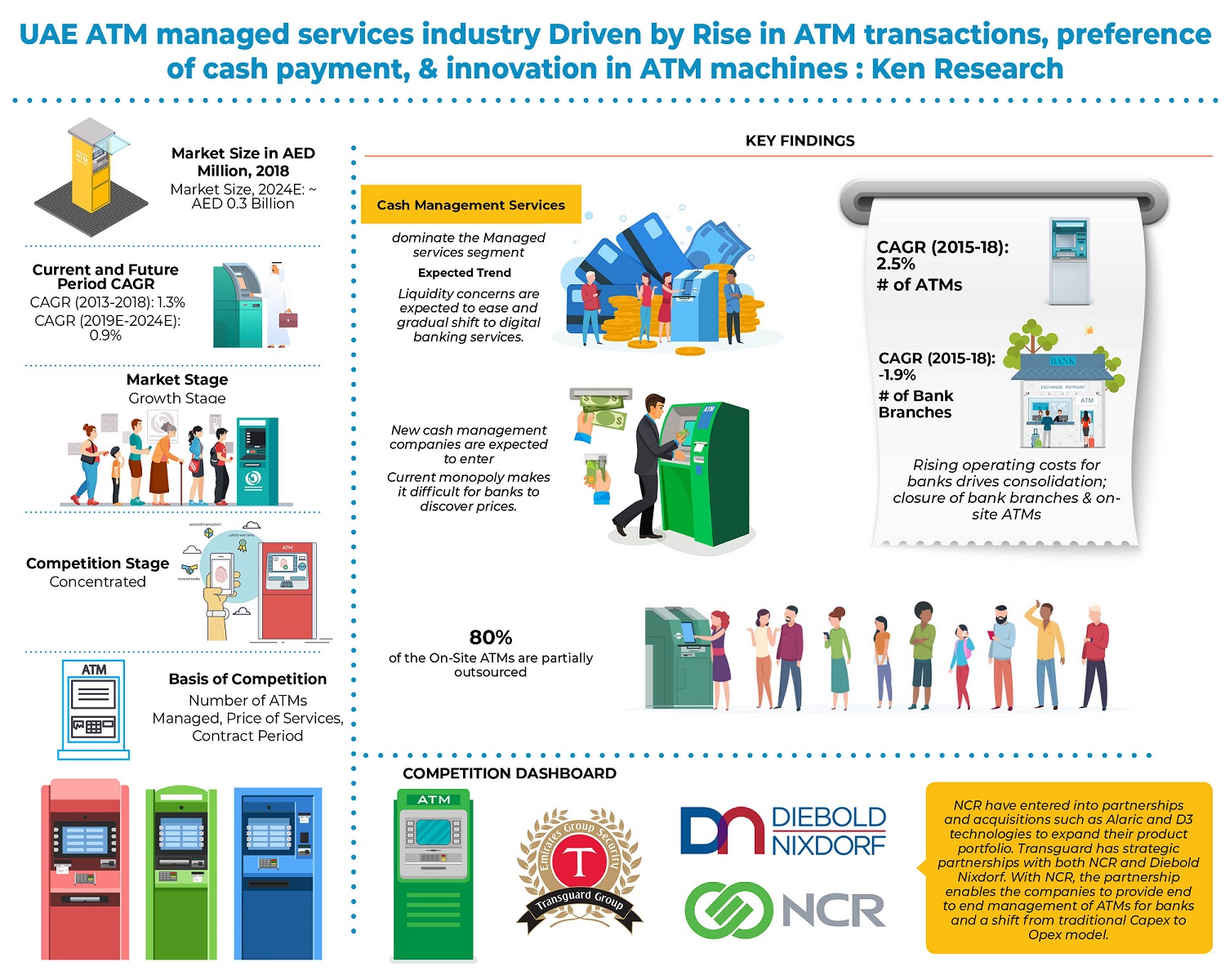

According to the report analysis, ‘UAE ATM Managed Services Market Outlook to 2024 – By Off-Site and On-Site ATMs and By Type of Service (Cash Management Services, ATM Maintenance Services and ATM Supply)’ states that the UAE ATM managed services market was witnessed to be operating at its growth stage, impending maturity as banks and ATM managed services companies commence investing in innovative technology to automate their services. The market is estimated to several in size owing to augment in cash management services market. Banks in UAE have taken several steps in order to decrease entire costs of operations. Apart from outsourcing management of the ATMs, banks have begun decrease their commercial footprint by closing down branches, merging with other banks and investment in technology-based services to decrease the reliance on ATMs for customer services.

Off-Site ATMs are installed in location where there are no branches such as hospitals, malls and airports among others. The segment registered in the UAE throughout 2018. Additionally, the management of off-site ATMs is wholly outsourced to the cash management companies. On-site ATMs on the other hand, are positioned near bank branches, electronic service units and representative offices. For such ATMs, cash management services and ATM maintenance services are outsourced while safety and surveillance services are accomplished by the banks themselves.

Competition stage within UAE ATM Managed Services Market was witnessed to be highly concentrated between three foremost companies. For cash management services, Transguard has a monopoly while Brink’s has just begun to enter the market with a small market share. Transguard developed its competitor G4S during 2018 to become the market leader in cash management and security services. Also, Transguard handles an enormous proportion of cash in circulation across the UAE while the remaining is controlled by banks. Finally, competition with ATM supply market of the UAE was also seen to be greatly concentrated amongst 2 companies namely NCR Corporation and Diebold Nixdorf.

At Ken Research, UAE ATM Managed Services Market Report provides a comprehensive analysis on the ATM managed services industry of UAE. The report covers several aspects comprising market overview, value chain and ecosystem analysis, market evolution, market segmentation by location of ATM i.e. off-site and on-site ATMs and by the type of service i.e. cash management services, ATM maintenance services and ATM supply services. The report also comprises trends and developments, challenges, foremost cost components and profitability analysis of ATMs around UAE, Regulatory framework and Snapshot on UAE ATM supply market. Competition scenario includes market share on foremost ATM suppliers on the basis of revenue and their company profiles. The report concludes with future prognoses in the UAE ATM Managed services space and analysts commendations for the same.

Request For Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=MjYzNjUz

The significant growth in requirement for better management of ATMs in order to advance the customer’s experience has led banks to implement the ATM managed services. Further, UAE ATM managed services market is predicted to develop at maximum pace throughout the review period on the account of augmenting the UAE ATM market.

UAE ATM managed services market is further predicted to develop in the forecast period 2018-2024, driven by rise in total ATM transactions, augmented card utilization and entry of countless players in the cash management services segment. The ATM maintenance market of UAE is predicted to decline as newer progressive technology in ATMs will be introduced over long term. The total number of ATMs is also predicted to deduct as consolidation in the banking industry is underway and as banks look to decrease costs, branches and ATMs are estimated be closed down.

The effective growth in need for better management and maintenance of ATMs is a foremost factor which is probable to bolster the market of ATM managed services in UAE region. Moreover, UAE is estimated to dominate the market of ATM managed services in this region over the review period. Moreover, Europe region is witnessing a proficient growth throughout the forecast period. This growth of ATM managed services market in Europe region can be attributed to aspects such increasing concern among several financial institutions towards consumer’s experience.

For More Information, refer to below link:-

UAE ATM Managed Services Market Research Report

Related Reports

Follow Us

LinkedIn | Instagram | Facebook | Twitter | YouTube

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

+91-9015378249