Saudi Arabia’s automotive market faced a decline in new car sales due to tripling of value-added tax (VAT) rates. Effective in July 1, 2020, Saudi Arabia hiked its VAT from 5% to 15%.

Vision 2030 trying to attract foreign investment to kick start Dammam manufacturing city to aid re-exports & fulfill domestic demand

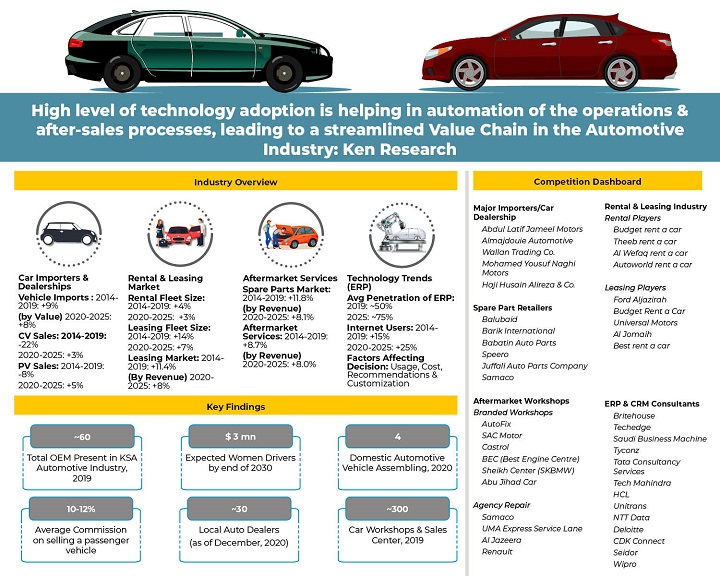

Surge in Domestic Manufacturing to gain independence of Imports: With Vision 2030, KSA is trying to gain impendence of imports, which basically fulfill ~85-90% of the overall automotive demand in KSA. The availability of only 4 domestic manufacturers in the country is a concern, which is being tackled by lucrative investment opportunities to develop EV & Light vehicle producing plants. Along with vehicles, KSA government is also providing opportunities to develop spare parts manufacturing plants & factories

Impact of COVID-19 on the Automotive Market: Saudi Arabia witnessed a country wide lockdown owing to the COVID-19 with all the industries shut across various province. The complete lockdown in the second quarter of 2020 left a mark on imports & new vehicle sales (down by 60% in July), as demand came to a halt for cross country movements, rental industry & share mobility market (down by ~70% for the 2nd quarter of 2020) also suffered drastically. However, covid-19 has opened various revenue schemes for players by providing them an online presence (E-Retailing penetration of new cars went from 0.5% to ~3% in only a month) & a new market altogether. Ownership period of cars has also increased, directly affecting used car & servicing & repair market

Influx of Domestic & International Capital: The National Industrial Cluster Development Program (NICDP) under the Ministry of Energy, Industry & Mineral Resources is formed to aid automotive related investors & companies in carrying out market research & provide market data to identifying best possible locations, sites, suppliers & staff. Help in evaluating business model options such as FDI, JV & more. The capital of the Saudi Industrial Development Fund (SIDF) has been increased by SR 6 bn ($1.6 bn) to help finance the kingdom’s industrial sector including entry into new industries & revenue streams. The fund provides loans & promotes other investment opportunities, mainly for MSMEs. They further plan to attract more FDI for new ventures as well.

Analysts at Ken Research in their latest publication ” KSA Automotive Industry Outlook to 2025 – Focus on Technology Adoption & Trends for Dealers, Distributors, Spare Parts Suppliers, Fleet and Leasing Companies and Car service providers)“observed that the there is a vast opportunity to disrupt the traditional & conservatively operating automotive Industry in the Kingdom of Saudi Arabia. The report discussed the current technology adoption amongst the various segments of players such as Importers, Distributors, Spare Part Dealers, Dealerships, Workshops, car Spas, Rental & Leasing Players amongst more.

Analysts at Ken Research in their latest publication ” KSA Automotive Industry Outlook to 2025 – Focus on Technology Adoption & Trends for Dealers, Distributors, Spare Parts Suppliers, Fleet and Leasing Companies and Car service providers)“observed that the there is a vast opportunity to disrupt the traditional & conservatively operating automotive Industry in the Kingdom of Saudi Arabia. The report discussed the current technology adoption amongst the various segments of players such as Importers, Distributors, Spare Part Dealers, Dealerships, Workshops, car Spas, Rental & Leasing Players amongst more.

The report further analyzed each segment in detail, providing a brief overview along with market size, segmentation, competition analysis, trends, developments & future analysis of various segments, focusing keenly on entity relationships & business models.

These segments are then further analyzed to gain a better understanding of the ERP & CRM modules required to pave the way for digitization amidst the industry, across KSA.

Key Segments Covered:

KSA Imports & Sales Industry (Distributors & Dealerships)

Import & Export Analysis

Competition Analysis of Major OEM Brands

Future Trends & Developments & Growth Factors

KSA Automotive Aftermarket Spare Parts & Service Industry

Spare parts Industry

Aftermarket Service Industry

Competition Analysis of Major Players via Cross Comparisons & Heat Maps

KSA Automotive Leasing & Rental Industry

KSA Rental Industry (Market Size, Competition & Segmentation)

KSA Leasing Industry (Market Size, Competition & Segmentation)

Impact of Covid-19 on KSA Automotive Industry

Impact of Covid 19 on KSA Automotive Industry

Mobility Industry looks forward to Utilize Digital Platforms

Post Covid KSA Automotive Industry Outlook

Technology Adoption & Usage Trends in KSA Automotive Industry

Overview of Industry

KSA Automotive Technology Trends, Adoption & Recommendations

Key Target Audience

KSA Car Dealerships

KSA Automotive Industry

KSA Automotive Workshops

KSA Spare Parts Retailers

KSA Automotive Logistic Service Providers

KSA Car Rental Players

KSA Car Leasing Players

KSA ERP Service Providers

KSA Technology Consultants

KSA Foreign Relation Ministry

KSA Customs Department

KSA Ports Authority

KSA Automotive Industry

KSA Imports & Export Authority

KSA Hardware Technology Manufacturers

KSA Software Technology Manufacturers

KSA Cloud Storage Providing Enterprises

KSA Public Institutions

Time Period Captured in the Report:

Historical Period: 2014-2019

Forecast Period: 2019-2025

Companies Mentioned:

Importers/Car Dealership

Abdul Latif Jameel Motors

Almajdouie Automotive

Wallan Trading Co.

Mohamed Yousuf Naghi Motors

Haji Husain Alireza & Co.

(Mazda, MAN, Aston Martin)

Nissan Petromin

Manahil International

Aljomaih Automotive Company

Universal Motors Agencies

Kia Al Jabr

Al Yemni Motors

Alissa Universal Motors Co.

Bakhashab Brothers Co.

Alesayi Motor Company

Al Jazirah Vehicles Agency

Juffali Automotive Company

Spare Part Retailers/Wholesalers

Balubaid

Barik International

Babatin Auto Parts

Speero

Juffali Auto Parts Company (JAPCO)

Samaco

M S Almeshri & Bros Co.

AL-OLIAH Auto Spare Parts

Delmon Group of Companies

SNAM

Ubuy

Munif Al Nahdi Group (Mize)

Odiggo

Accidom

Bawazeer Auto Parts

Bin sahib

AHQ Parts

Danya Auto Parts

Rezayat Automotive

Saudi Parts Center Company (Al Khorayef Group)

Aftermarket Service Providers

Branded Workshops

AutoFix

SAC Motor

Castrol

BEC (Best Engine Centre)

Sheikh Center (SKBMW)

Abu Jihad Car Maintenance Center

Ac Delco Service Centres

Tyre Plus

3M Authorized Centre

Mize

AdinLub

Car Spa

Car Hub

Ezhalha

Petromin Express

Auto Hub

Exxon Mobil

Autoworld

Castrol Branded Workshops

Shell Fastlube

Fuchs One

NAFT

Ziebart

Grease Monkey

Quick Car Service

Morni

Agency Repair

Samaco

United Motors Express Service Lane

Al Jazeera

Renault

Kia Motors

Fast Auto Technic

Mohammed Yousaf Naghi Motors

Porsche

Land Rover

Quick lane

Nissan Petromin

Haji Husain Alireza & Co.

Universal Motors Agencies

Aljomaih Automotive Company Ltd.

Alesayi Motors

Al Yemni Motors

Alissa Universal Motors Co.

Bakhashab Brothers Co

Al Juffali & Brothers Automotive Ltd.

Wallan Hyundai

Un-Organized/ Independent Players

Middle East Auto Services

Carzzone

German Centre

Cartech

Alod Haib

Al-Aruba Sinnaiyah

Saudi Chinese Vehicle Repair

Al Shamel Car Maintenance Center

Al Nafie Car Maintenance Workshop

Alsajow Center for Car Maintenance

Red Car

Saudi Egyptian Center for Car Maintenance

SRT 8

Al Bayan Car Maintenance

Mujahid Garage

1 Check Car Services (One Examination Workshop)

Saudi radiators

Global Auto Maintenance

Mohammed Al- Tkhais Abu Rakan

Anwar Al Mamlaka Center

Quick Cars Service

Best Corner Car Maintenance

American Diamond Specialist Center

Cars electricity and air conditioning

Badr Sentop workshop BST

Grace Monkey (International Company)

Super Service Auto Center

XEOEX

German Centre

AutoGard

Rental & Leasing Industry

Rental Players

Budget rent a car

Theeb rent a car

Al Wefaq rent a car

Autoworld rent a car

Key rent a car

Avis rent a car

Hanco rent a car

Samara rent a car

Hertz rent a car

Autorent a car

Leasing Players

Ford Aljazirah

Budget Rent a Car

Universal Motors

Al Jomaih

Best rent a car

Al Tayyar rent a car

Enterprise rent a car

Hanco rent a car

Theeb rent a car

Shary rent a car

ERP & CRM Providing Technical Consultants

Britehouse

Techedge

Saudi Business Machine

Tyconz

Accenture

Tata Consultancy Services

Tech Mahindra

HCL

Unitrans

NTT Data

Deloitte

CDK Connect

Seidor

Wipro

Key Topics Covered in the Report:

Saudi Arabia Automotive Industry Overview

Saudi Arabia Imports & Sales Industry (Distributors & Dealerships)

Automotive Imports & Sales Industry Ecosystem, KSA

Value Chain Analysis of KSA Automotive Imports & Sales

Annual Automotive Imports Traffic for Major KSA Ports

Analysis of Imported Goods & Major Countries Importing in KSA

Value & Volume of Vehicles Imported, KSA

Segmentation of Imports on the basis of Vehicle Type, KSA

Automotive Vehicle Manufacturing Clusters Analysis, KSA

New Motor Vehicle Sales, KSA

Market Segmentation of Automotive Sales on the basis of Region, KSA

Demographics of KSA Citizens Supporting Automotive Industry, (2019)

Segmentation of Vehicle Sales on the basis of Brands & Vehicle Type, KSA

Market share of International OEMs in New Vehicle Sales, KSA (2019)

Competition Analysis of Automotive Imports & Sales Industry, KSA (2019)

Profiles of Major Dealerships & Distributors

Business Model & Revenue Stream of Importers/Distributors/Dealerships

Trends & Developments in Automotive Vehicle Industry

Future of Imports & Sales

KSA Automotive Aftermarket Spare Parts & Service Industry

KSA Aftermarket Industry Ecosystem

Aftermarket Spare Parts Industry

KSA Aftermarket Service Industry

Future Trends of Aftermarket Spare Parts & Service Industry

KSA Automotive Leasing & Rental Industry

Macroeconomic Overview of the Rental & Leasing Industry

KSA Automotive Leasing (Long Term) Industry

KSA Rental Industry

Future of Leasing & Rental Industry

Impact of Covid-19 on KSA Automotive Industry

Impact of Covid 19 on KSA Automotive Industry

Mobility Industry looks forward to Utilize Digital Platforms

Post Covid KSA Automotive Industry Outlook

Technology Adoption & Usage Trends in KSA Automotive Industry

Overview of Industry

KSA Automotive Technology Trends, Adoption & Recommendations

For more information on the research report, refer to below link:

Related Reports:-

Contact Us:

Ken Research

Ankur Gupta, Head Marketing & Communications

+91-9015378249